- Third quarter 2023 U.S. prodisc® Total Disc Replacement (TDR) revenue approached $14 million in sales—a new record—exceeding second quarter 2023, the company’s previous best quarter.

- Third quarter 2023 worldwide prodisc TDR remained strong by product segment, with global lumbar TDR growing 43%—a new revenue record— and global cervical TDR growing 75%.

- Year-to-date worldwide prodisc TDR revenue of $49 million through the third quarter is up 55% over prior year.

- Strong global revenue growth and operational performance resulted in Centinel Spine’s second consecutive EBITDA-positive quarter.

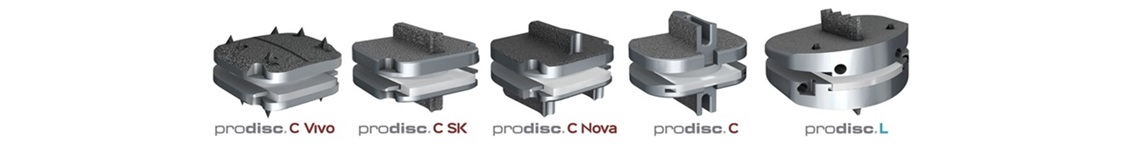

WEST CHESTER, Pa., Nov. 2, 2023 /PRNewswire/ — Centinel Spine®, LLC, (“the Company”) the leading global medical device company addressing cervical and lumbar spinal disease with the most clinically-proven total disc replacement (TDR) technology platform in the world (prodisc®), today announced record third quarter 2023 prodisc TDR financial results. Strong operational performance coupled with 61% year-over-year global revenue growth in Q3 2023 resulted in the Company achieving its second consecutive EBITDA-positive quarter. Centinel Spine’s strong quarterly results were driven through a record number of prodisc surgeon users, as well as accelerated procedure volume and user adoption of the Company’s new prodisc C Vivo and prodisc C SK cervical TDR system.

According to one of the early adopters of the new prodisc cervical system, Neurosurgeon John S. Shiau, MD, of Maplewood, NJ and Manhattan, NY, “I believe in the advantages of cervical disc replacement over fusion in my patients. The functional recovery and the long-term results are fantastic. I have been very happy with the different disc replacements available from Centinel Spine. I can choose the implant that best achieves my surgical goals of functional stabilization. In addition, I can pick the implant that fits the anatomy, rather than changing the anatomy to fit the implant. This maximizes the chance of achieving successful outcomes in my patients. For these reasons, depending on the clinical setting, I continue to use both the original prodisc C implant and the prodisc C Vivo implant. For example, if the superior endplate is flat, then the prodisc C better fits the anatomy; if the endplate is concave, then I choose the domed prodisc C Vivo. The prodisc C Vivo implant is an improvement in terms of ease of insertion.”

Centinel Spine CEO Steve Murray shared, “We are pleased with the progress Centinel Spine is making in the total disc replacement market this year. The Company is exclusively and entirely focused on becoming the unrivaled leader in TDR and expanding the market as we grow. In both cervical and lumbar disc replacement, surgeons see the benefit of our Match-the-Disc family of anatomic discs. The clinical benefits of total disc replacement are clear and impeccably reported in the many studies of their safety and effectiveness—and, increasingly, patients seek treatment pathways that maintain motion and reduce the likelihood of future surgery. We will continue putting our full effort into advancing patient care in all we do.”

Third Quarter 2023 Highlights

Third quarter 2023 worldwide prodisc franchise revenue exceeded $17 million, up 61% over prior year, with prodisc cervical growing 75% and prodisc lumbar increasing 43% over 2022.

U.S. prodisc revenue grew 71% in Q3 versus prior year. Quarterly sales reached a record $14 million, driven by the continued success of the new prodisc C Vivo and prodisc C SK cervical TDR system and nearly 40% year-over-year prodisc lumbar growth. U.S. prodisc cervical revenue grew over 100% in Q3 2023 versus prior year.

The U.S. prodisc surgeon user base grew more than 50% over prior year—including 70% growth in prodisc cervical users. New prodisc users more than tripled vs. Q3 2022. Furthermore, the total number of U.S. healthcare facilities using prodisc TDR products exceeded 465, an increase of 45% over prior year, and the number of distributors selling prodisc expanded nearly 30% versus Q3 2022.

International Q3 2023 prodisc TDR revenues grew 30% over Q3 2022, propelled by 85% growth in prodisc lumbar sales.

Highlights on New Cervical prodisc TDR System One Year after U.S. Launch

U.S. market acceptance of the new prodisc C Vivo and prodisc SK system remains strong, with almost 380 surgeons now using the system—a sequential user growth of nearly 30% over Q2 2023. The Company achieved the 2,500-procedure milestone with the new prodisc C Vivo and prodisc C SK system in September, just five months after the 1,000th case was announced in April 2023. Nearly 900 procedures were completed with the new system in the third quarter of 2023, a 15% sequential procedure volume growth over Q2 2023.

The average monthly U.S. surgeon user base for the new prodisc C Vivo and prodisc C SK system continued to expand in Q3 2023, with an increase of nearly 10% over the prior quarter. The prodisc C Vivo and prodisc C SK surgeon user base also remains committed to the new system, with the majority being competitive conversions and repeat users.

Year-to-Date 2023 Performance

Year-to-date September 2023 worldwide prodisc TDR revenue of $49 million represents a year-over-year increase of 55%. Record sales across geographical segments were also strong during the first 9 months of 2023, with year-over-year U.S. prodisc sales growing 61% and International sales growing 36%. New surgeon growth was driven by Company Medical Education programs that have trained over 750 surgeons, year-to-date.

Year-to-date Q3 U.S. prodisc TDR revenues approached $38 million, driven by a rapidly increasing surgeon user base, as well as repeat usage within the existing customer base. Through Q3, the U.S. prodisc TDR surgeon user base expanded by more than 50%, year-over-year.

The year-over-year growth of the U.S. prodisc cervical surgeon base was particularly strong, expanding by over 65% through the end of Q3 2023. Lastly, over 85% of the prodisc TDR cervical surgeon user base has repeated usage year-to-date versus the same period in 2022.

Year-to-date Q3 International prodisc TDR revenues have grown 36% over 2022, propelled by 55% prodisc lumbar growth and prodisc cervical sales growth of 30% over 2022.

Full-Year 2023 Outlook

Looking ahead to full-year 2023, the Company raised its projection and anticipates its global prodisc TDR business will exceed 50% year-over-year, significantly outpacing projected market growth of 11% (source: Artificial Disc Market Insights, Competitive Landscape and Market Forecast-2027, DelveInsight Business Research LLP, 2022). Full-year growth will continue to be driven through the prodisc global lumbar business and continued expansion of the newly launched prodisc C Vivo and prodisc C SK cervical system.

About Centinel Spine, LLC

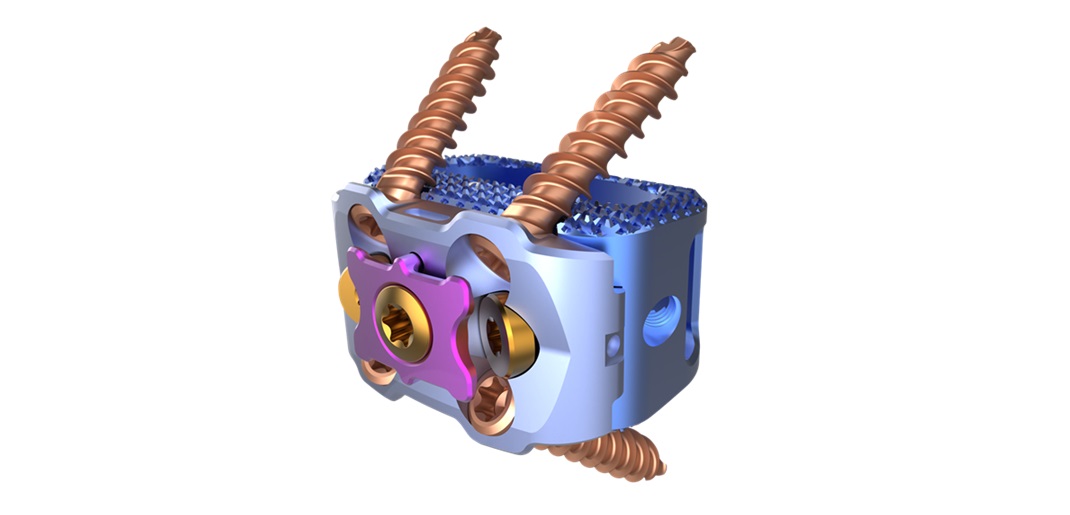

Centinel Spine®, LLC is the leading global medical device company addressing cervical and lumbar spinal disease with the most clinically-proven total disc replacement (TDR) technology platform in the world (prodisc®). The Company’s prodisc technology is the most studied and clinically-proven TDR system across the globe, validated by over 540 published papers and more than 250,000 implantations worldwide.

Centinel Spine continues to advance its pioneering culture and corporate mission to become a catalyst of change in the spine industry and alter the way spine surgery is perceived. The prodisc platform remains the only technology with multiple motion-preserving solutions for both cervical and lumbar anterior column reconstruction.

For more information, please visit the company’s website at www.CentinelSpine.com or contact:

Varun Gandhi

Chief Financial Officer

900 Airport Road, Suite 3B

West Chester, PA 19380

Phone: 484-887-8871

Email: v.gandhi@centinelspine.com

SOURCE Centinel Spine, LLC