Dublin, March 11, 2025 (GLOBE NEWSWIRE) — The “Hip Replacement Market Report by Product, End-User, Regions and Company Analysis 2025-2033” report has been added to ResearchAndMarkets.com’s offering.

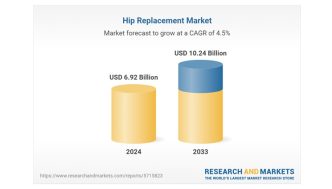

Hip replacement market will grow, reaching nearly US$10.24 billion by 2033; by contrast, in 2024, it was US$6.92 billion. This increase is estimated to be a compound annual growth rate of 4.45% from 2025 to 2033.

Some reasons for such an expansion are a growing older population, increasing cases of obesity, and enhanced surgical techniques through medical technology, which improves recovery times and outcomes for patients who undergo hip replacements.

Hip replacement is a type of surgery wherein a diseased or damaged hip joint is removed and replaced with an artificial substitute, usually metal, ceramic, or plastic. This surgery is usually recommended to patients who suffer from severe pain, reduced mobility, or deteriorating joints brought about by diseases like arthritis, fractures, or any other conditions. The surgery is likely to have a great improvement in the quality of life through the relief of pain and joint functioning, which may enable patients to live their lives better.

Hip replacement has been a very popular procedure for many years because of improvements in surgical techniques and implant technology. Minimally invasive approaches and durable materials have reduced recovery times and improved outcomes. Moreover, an aging population and the prevalence of osteoarthritis have contributed to the rising demand for this procedure. Younger patients also opt for hip replacements as active lifestyles lead to joint wear and injuries. High success rate, better access to healthcare, and awareness increase its acceptance, making it a standard treatment option worldwide.

Growing Factors for Hip Replacement Market

Aging Population Worldwide

The major driver for increasing hip replacement demand is due to the aging population worldwide. With advancing age, the conditions like osteoarthritis and hip fracture enhance the trend for joint replacement surgery. The elderly is more likely to experience joint degeneration, causing pain and limited mobility. With an increasing number of elderly individuals seeking solutions to maintain independence and quality of life, the demand for hip replacements is expected to rise, particularly in developed countries with aging demographics.

By 2030, 1 in 6 people will be 60 years or over. The share of population aged 60 years and over is going to be 1.4 billion in the year 2020 to 1.4 billion, which will increase double times, or 2.1 billion by 2050. The population aged 60 years and above in the world is going to increase threefold. The persons aged 80 years or more will be around 426 million by 2050.

Advancements in Implant Technology

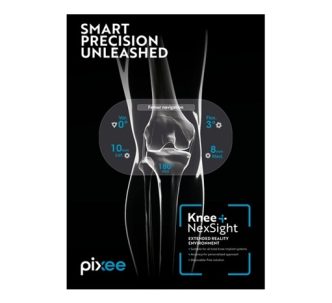

Technological advancements in the implant materials and surgical techniques have dramatically improved the success rate of hip replacements. The modern implants are made from long-lasting materials like ceramics, titanium, and alloys, providing more durable results with less wear. Furthermore, minimal invasive techniques bring quicker recovery, smaller incisions, and less risk of complications.

These innovations make hip replacement surgery more attractive to patients and healthcare providers, driving market growth by enhancing the quality of care and outcomes. Feb 2023, Maxon released several new motors at MD&M West, including a series suitable for surgical robots and implants and a line of frameless DT motors with internal rotor technology. The ECX SPEED 8 motors with pin connection also have a pin connection for a space-saving design.

Increasing Awareness and Accessibility

The awareness of the benefits of hip replacement surgery and the accessibility of health care have also driven the market forward. More patients are aware of the options for treatment for hip pain and mobility problems, thus leading to earlier intervention. Additionally, rising coverage of healthcare systems and insurance policies for joint replacement surgeries further reduce the procedure’s cost. Specialized surgeons and better infrastructure for healthcare facilitate easy access for patients to the hip replacement surgery, thus supporting market growth.

For example, as per the report from a study in the National Center of Biotechnology Information, a total of about 572,000 total hip arthroplasty cases will be reported by the year 2030. Additionally, as per the American Joint Replacement Registry study in 2022, between 2012 and 2021 in the U.S., there were about 2,550,530 hip and knee arthroplasty procedures, including both primary and revision surgeries, out of which around 37.3% were primary hip surgeries.

Challenges in the Hip Replacement Market

High Surgery Costs

Despite growing demand, one of the significant challenges in the hip replacement market is the high cost of the procedure, including hospital stays, surgical fees, and post-surgery rehabilitation. These costs can be prohibitive for patients without adequate insurance coverage, particularly in developing countries or regions with less accessible healthcare. High costs can limit the adoption of hip replacement surgery, especially among middle-income populations, creating barriers to access and slowing market growth in specific demographics.

Risk of Complications and Revisions

Hip replacement surgeries are typically very successful. However, it is not impossible to have associated risks with such a procedure as infections, blood clots, and implant failure. Some people may need their implants revised either because they break down, work loose, or cause complications to the patient at a later stage. This has implications on increasing healthcare costs, which may go on for a while. Challenges include complications, potential revision surgeries, and impact on the general perception of the procedure by both patients and providers.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 180 |

| Forecast Period | 2024 – 2033 |

| Estimated Market Value (USD) in 2024 | $6.92 Billion |

| Forecasted Market Value (USD) by 2033 | $10.24 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

Company Analysis: Overview,Recent Developments, Sales Analysis

- Smith & Nephew PLC

- Johnson & Johnson

- Integra lifesciences Corporation

- Zimmer Biomet

- Stryker

- B. Braun Melsungen AG

- Globus Medical Inc

- MicroPort Scientific Corporation

- Conformis Inc

Key Topics Covered:

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Hip Replacement Market

6. Market Share

6.1 By Products

6.2 By End User

6.3 By Countries

7. Products

7.1 Total

7.2 Partial

7.3 Revision & Hip Resurfacing

8. End User

8.1 Hospitals & Surgery Centers

8.2 Orthopedic Clinics

8.3 Others

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East and Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

9.6 Rest of World

10. Porter’s Five Forces

10.1 Bargaining Power of Buyer

10.2 Bargaining Power of Supplier

10.3 Threat of New Entrants

10.4 Rivalry among Existing Competitors

10.5 Threat of Substitute Products

11. SWOT Analysis

11.1 Strengths

11.2 Weaknesses

11.3 Opportunities

11.4 Threats

12. Key Players Analysis

For more information about this report visit https://www.researchandmarkets.com/r/d175pw

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.