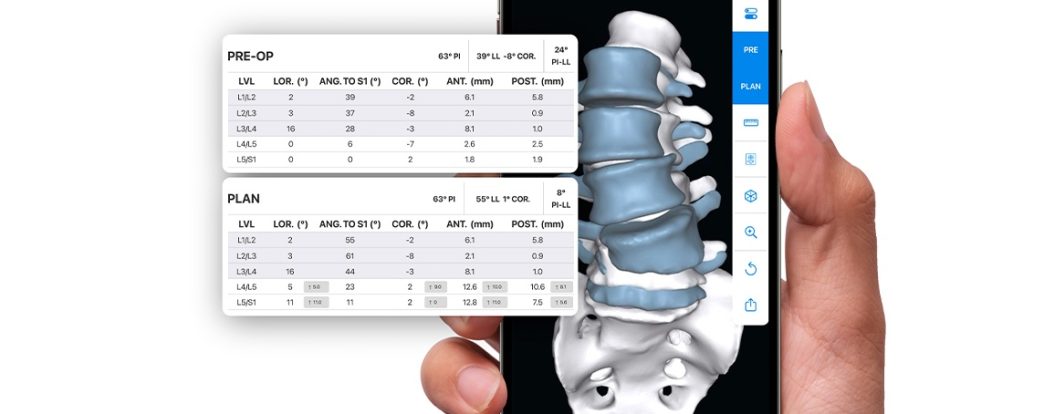

The myaprevo AI-powered software integrates multiple layers of data, including detailed 3D imaging, patient-specific anatomy and pathology, spinopelvic parameters, surgeon preferences, and real-world outcomes data. Photo: Carlsmed.

The spine surgery technology market is dynamic and more likely than other orthopedic sectors to attract small- to mid-size companies.

September 15, 2025 – By: Sam Brusco, Associate Editor –

The spine surgery technology market is in the midst of significant changes, with the main players adapting their strategies to respond to shifting industry dynamics.

One notable development arose from Stryker in April, when the company exited the market by selling its U.S. spinal implants business to Viscogliosi Brothers to form VB Spine. The new company will have exclusive access to Stryker’s robotic Mako Spine and Copilot portfolio for use with its implants.

The spine tech market is quite competitive, with innovation leading many companies’ strategies. The market is dominated by a few major players, with Medtronic, Globus Medical, and Johnson & Johnson MedTech controlling over half the market share. Unlike other orthopedic segments like the knee and hip replacement implants market, the spine sector witnesses influxes of new companies and products.

The market has become highly dynamic due to strong surgeon influence, low barriers to entry, and the need for constant innovation. To stay ahead, companies must continually innovate either through the development of new implants, improved surgical techniques, or advanced technologies.

Key spine technology trends include the growing use of robotics, artificial intelligence (AI), and advanced imaging for precision surgery. There is also movement toward minimally invasive techniques, personalized medicine, and new biomaterials for spinal implants.