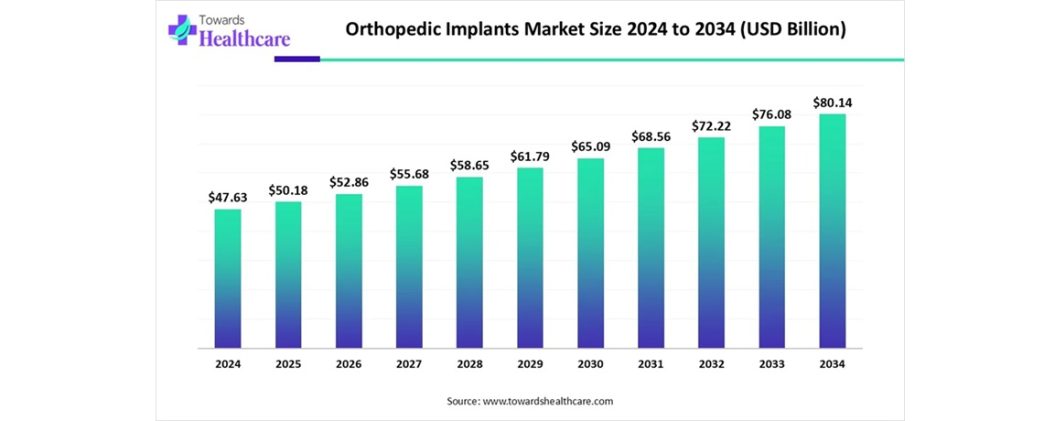

The global orthopedic implants market size was valued at USD 50.18 billion in 2025 and is predicted to hit around USD 80.14 billion by 2034, rising at a 5.34% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Jan. 30, 2026 (GLOBE NEWSWIRE) — The global orthopedic implants market size is calculated at USD 52.86 billion in 2026 and is expected to reach around USD 80.14 billion by 2034, growing at a CAGR of 5.34% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5601

Key Takeaways

- North America accounted for the largest share of the market in 2024.

- Asia-Pacific is expected to be the fastest-growing region in the coming years.

- By product, the joint reconstruction segment dominated the orthopedic implants market in 2024.

- By product, the spinal implant segment is expected to grow significantly during 2025-2034.

- By end-user, the hospitals and ambulatory surgery segment registered dominance in the market in 2024.

- By end-user, the orthopedic clinics and others segment is expected to witness rapid expansion in the studied years.

What are the Extensive Advances in Orthopedic Implants?

The orthopedic implants market covers several biocompatible medical devices that are made of titanium alloys, stainless steel, or specialized plastics & surgically inserted to replace, support, or stabilize damaged bones and joints. This market is primarily fueled by the increasing geriatric population, the accelerating cases of musculoskeletal disorders, and innovations in 3D- printed, tailored implants. Recently, rigorous trials employed instrumented spinal rods that record load sharing between the implant and bone to ensure adequate fusion. Also, certain steps explored sensor-enabled tibial trays for the transmission of load distribution data in total knee arthroplasty.

What are the Major Drivers in the Orthopedic Implants Market?

An immensely expanding ageing population is highly prone to degenerative bone conditions, specifically osteoporosis and arthritis, and growing incidences of fractures, sports injuries, and traumatic injuries are increasingly demanding advanced implants. Accelerating disposable income, well-developed healthcare systems, and continuous groundbreakings in implant materials, like titanium, ceramics, 3D printing, smart implants, and robotic-assisted surgeries are driving the overall market expansion.

What are the Key Drifts in the Orthopedic Implants Market?

- In December 2025, Medi-Mold partnered with OIC International (USA) and AddUp (France) to develop a state-of-the-art 3D printed orthopaedic implant manufacturing facility in Vizag.

- In October 2025, CustoMED strengthened its global reach with $6M investment in AI-powered orthopedic care.

What is the Significant Limitation in the Orthopedic Implants Market?

The need for greater expenditure on advanced implants and robotic-assisted surgeries is developing into a vital financial hurdle for patients. Alongside, the emergence of a strict regulatory approvals process by the FDA/EMA and a major lack of trained orthopedic surgeons is also creating a barrier to market growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Regional Analysis

What Made North America Dominant in the Market in 2024?

North America captured the biggest revenue share of the market in 2024, due to escalated sports injuries, demand for minimally invasive procedures, and technological breakthroughs, such as 3D-printed and bioresorbable implants. The U.S. researchers are shifting towards human trials for Magnesium (Mg) screws and pins, which facilitate initial stability and then dissolve as novel bone forms.

For instance,

- In October 2025, the University of Utah Orthopaedic Innovation Center launched the advanced Dynamic Compression Implant System to revolutionize fracture fixation, joint fusion, and osteotomy stabilization.

In the U.S., the orthopedic implants market is growing strongly, supported by the rising incidence of bone and joint disorders and an aging population, increasing demand for joint replacements and spinal procedures. Technological advancements in implant materials, minimally invasive surgery, and surgical robotics are further enhancing adoption and procedural volumes.

Canada’s orthopedic implants market is expanding steadily, driven by increasing demand for joint-replacement and trauma procedures amid an aging population and growing incidence of musculoskeletal disorders. Advances in surgical technology, healthcare infrastructure investments, and rising orthopedic surgical volumes are strengthening market activity and long-term outlook.

Why did the Asia Pacific Expanded Notably in the Orthopedic Implants Market in 2024?

In the future, the Asia Pacific is predicted to grow fastest in the orthopedic implants market. Particularly, China and India are experiencing a huge geriatric population, and are promoting substantial investments in public healthcare infrastructure and broader insurance coverage. Alongside, China is exploring high-end personalization, smart surgical technologies, and 3D printing solutions. Involvement of firms, such as TINAVI and Changmugu are evolving closed-loop systems that combine AI-powered preoperative planning with intraoperative robotic navigation, like the Tirobot Recon approved for total knee replacements.

In China, market expansion is driven by demographic shifts toward an older population and increasing prevalence of musculoskeletal conditions, boosting demand for joint replacement, spinal, and trauma implants. Healthcare infrastructure improvements, adoption of advanced surgical technologies, and rising awareness of orthopedic treatments are also fueling sustained growth across urban healthcare settings.

In India, growth in orthopedic implants is fueled by rising joint replacements, trauma cases, and expanding healthcare access, especially in tier-2 and tier-3 cities. Enhanced domestic manufacturing, government support for local production, and increasing medical tourism are further boosting the adoption of affordable, quality implant solutions.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By product analysis

Which Product Led the Orthopedic Implants Market in 2024?

In 2024, the joint reconstruction segment registered dominance in the market. Drivers are the accelerating cases of osteoarthritis and a greater demand for minimally invasive procedures. Also, the world is highly fostering robotic-assisted surgery and 3D-printed patient-specific implants. Recent developments encompass Smith & Nephew’s CORI and Corin’s Apollo & BalanceBot, which offer real-time, AI-assisted ligament tension data and improved component positioning.

On the other hand, the spinal implant segment will witness lucrative growth. Mainly among the ageing population, there are growing instances of degenerative disc disease, spinal stenosis, scoliosis, and vertebral fractures, which are widely demanding these implants. Researchers are putting efforts into motion-preserving artificial discs and smart implants to monitor recovery. The Globus Medical HILINE System was rolled out for cervical and thoracolumbar spinal stabilization and scoliosis correction.

By end-user analysis

How did the Hospitals and Ambulatory Surgery Segment Dominate the Market in 2024?

The hospitals and ambulatory surgery segment held the biggest share of the market in 2024. This dominance is led by patients and insurers preferring cost-effective, outpatient procedures for joint replacements and suitable reimbursement policies for surgeries in both hospitals and ASCs. Alongside, these facilities are promising clinical studies for bioabsorbable magnesium implants to facilitate structural support for fractures and then dissolve.

Moreover, the orthopedic clinics and others segment is anticipated to grow fastest. These clinics are highly managing expanding cases of osteoarthritis, osteoporosis, and obesity, which fuels demand for hip, knee, and spinal replacements. Also, they are promoting the connection of devices to smartphones and cloud-based analytics, which enables surgeons to make evidence-based adjustments without invasive diagnostic procedures.

What are the Extensive Developments in the Orthopedic Implants Market?

- In January 2026, Spineology Inc. rolled out OptiMesh HA Nano, which integrates Spineology’s expandable implant technology with Promimic AB’s HA Nano Surface, to transform spinal fusion surgeries.

- In January 2026, MTF Biologics and Kolosis BIO launched Summit Matrix, a sophisticated synthetic bone graft to enhance bone regeneration after orthopedic and spinal surgeries.

- In December 2025, Kapadia Hospital unveiled MISSO, India’s foremost AI-enabled orthopedic surgery system, with 100 completed joint and knee procedures.

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

Top Companies and Their Contributions to the Market’s Growth

| Company | Key Offerings | Primary Focus | Innovations/Contributions | Notes |

| Biomet Holdings, Inc. | Hip, knee, shoulder, fixation devices, support tools | Reconstructive orthopedic products | Precision-engineered implants and instruments for joint replacement and trauma care | Now part of Zimmer Biomet; legacy in orthopedic reconstructive devices. |

| Stryker Corporation | Joint replacements (hip, knee, shoulder), trauma, extremities, and surgical equipment | Comprehensive orthopedic surgery solutions | Advanced implant systems with robotic and navigation support, enhancing surgical accuracy and outcomes | Global portfolio used in millions of surgeries worldwide. |

| Medtronic plc | Spinal implants, neurosurgical, and biologics solutions | Spine and related orthopedic implants | Innovations in spinal fusion technologies and biologics supporting bone healing | Strong R&D in spinal surgery tools and systems. |

| BioTek Instruments, Inc. | Precision implants for the knee, shoulder, hip, and extremities | Orthopedic implant manufacturing | Engineered implants for joint and trauma procedures with sports medicine emphasis | Offers CE-certified products across orthopedic segments. |

| Arthrocare Corporation | Hip fixation implants and surgical devices | Minimally invasive orthopedic tools | Developed Coblation-based soft-tissue and hip fixation implants | Acquired by Smith & Nephew; known for Coblation technology. |

Orthopedic Implants Market Key Players List

- Biomet Holdings, Inc.

- Stryker Corporation

- Medtronic plc

- BioTek Instruments, Inc

- Arthrocare Corporation

- Orthopedic Implant Company

- Smith and Nephew plc

- Integra Life Sciences Holdings Corporation

- NuVasive, Inc

- Aesculap Implant System

Browse More Insights of Towards Healthcare:

The global dermatology market size is calculated at USD 1.51 billion in 2025, grew to USD 1.61 billion in 2026, and is projected to reach around USD 2.95 billion by 2035. The market is expanding at a CAGR of 6.94% between 2026 and 2035.

The Parkinson’s disease diagnosis and treatment market is expected to increase from USD 7.49 billion in 2025 to USD 17.57 billion by 2035, growing at a CAGR of 8.9% throughout the forecast period from 2026 to 2035.

The anxiety disorders treatment market is expected to grow from USD 12.33 billion in 2025 to USD 17.56 billion by 2035, with a CAGR of 3.6% throughout the forecast period from 2026 to 2035.

The chronic obstructive pulmonary disease market size is projected to reach USD 36.29 billion by 2035, growing from USD 23.55 billion in 2025, at a CAGR of 4.42% during the forecast period from 2026 to 2035.

The global behavioural mental health tools market size was estimated at USD 3.36 billion in 2025 and is predicted to increase from USD 3.85 billion in 2026 to approximately USD 13.28 billion by 2035, expanding at a CAGR of 14.74% from 2026 to 2035.

The rheumatoid arthritis drugs market is projected to reach USD 30.65 billion by 2035, growing from USD 19.55 billion in 2025, at a CAGR of 4.6% during the forecast period from 2026 to 2035.

The veterinary vaccines market size is calculated at US$ 10.04 billion in 2025, grew to US$ 10.65 billion in 2026, and is projected to reach around US$ 18.11 billion by 2035. The market is expanding at a CAGR of 6.07% between 2026 and 2035.

The global topical drug delivery market size is calculated at US$ 268.96 billion in 2025, grew to US$ 292.52 billion in 2026, and is projected to reach around US$ 622.85 billion by 2035. The market is expanding at a CAGR of 8.76% between 2026 and 2035.

The global digital therapeutics for mental health market size was estimated at USD 3.74 billion in 2025 and is predicted to increase from USD 4.51 billion in 2026 to approximately USD 24.42 billion by 2035, expanding at a CAGR of 20.64% from 2026 to 2035.

The huntington’s disease treatment market is projected to reach USD 1519.02 million by 2035, growing from USD 716.79 million in 2025, at a CAGR of 7.8% during the forecast period from 2026 to 2035.

Segments Covered in the Report

By Product

- Joint Reconstruction

- Knee

- Hip

- Extremities

- Spinal Implants

- Spinal Fusion Devices

- Spinal Non-Fusion Devices

- Trauma Implants

- Others

By End-user

- Hospitals & Ambulatory Surgery Centers

- Orthopedic Clinics & Others

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5601

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest