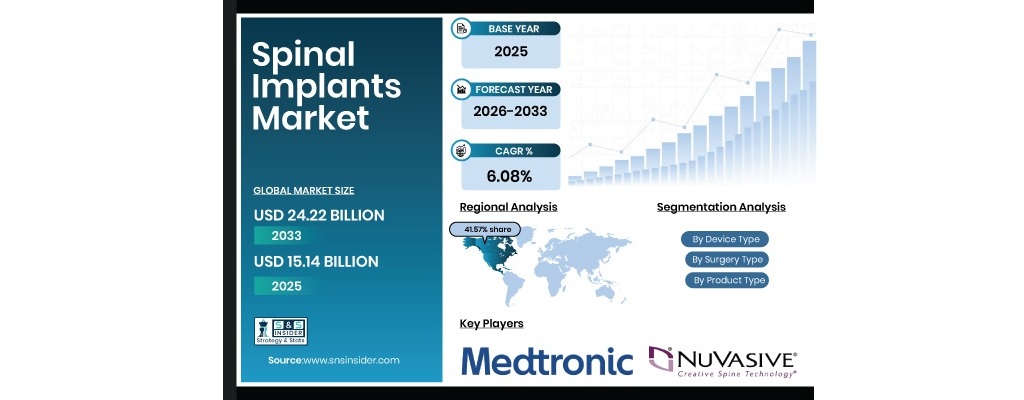

Growing Burden of Degenerative Spine Disorders and Rapid Adoption of Bio-Materials Fuel Global Market Expansion at 6.08% CAGR.

Austin, United States, Feb. 12, 2026 (GLOBE NEWSWIRE) — Spinal Implants Market Size & Growth Analysis:

According to SNS Insider, The Spinal Implants Market is valued at USD 15.14 Billion in 2025 and is projected to reach USD 24.22 Billion by 2033, expanding at a CAGR of 6.08% during 2026–2033.

Technological advancements in surgical procedures, bio-materials, and the increasing adoption of minimally invasive and motion-preserving techniques continue to drive the Spinal Implants Market across the globe. The demand is also being fueled by a rising incidence of spinal disorders and trauma. The trend is shifting toward patient-specific implants, navigation-guided surgery, and bioactive materials that accentuate fusion and recovery. The competitive forces are further shaped by developments in R&D investments and collaborations in the industry.

Get a Sample Report of Spinal Implants Market: https://www.snsinsider.com/sample-request/9024

Market Size and Forecast:

- Market Size in 2025: USD 15.14 Billion

- Market Size by 2033: USD 24.22 Billion

- CAGR: 6.08% from 2026 to 2033

- Base Year: 2025

- Forecast Period: 2026–2033

- Historical Data: 2022–2024

U.S. Spinal Implants Market Analysis

The U.S. market is expected to grow from USD 4.25 Billion in 2025E to USD 6.53 Billion by 2033, at a CAGR of 5.54%. High prevalence of degenerative spine disorders including spondylosis and spinal stenosis, increasing prevalence of disc surgery and growing adoption of minimally invasive and artificial disc surgery in the U.S. market. Rapid adoption of technology and adoption of reimbursement also drive growth in the U.S. market.

The Rising Burden of Degenerative Spine Disorders Remains a Primary Driver of Spinal Implants Market Growth.

The patient population requiring surgical intervention is growing due to aging demographics, sedentary lifestyles, increasing obesity, and labor-related stresses. Advancements in complex stabilization procedures are increasingly necessitated as a result of disc degeneration, spondylolisthesis, and spinal deformities.

Spinal implants provide biomechanical stability, joint reduction, and motion preservation, resulting in a significantly higher long-term functional success away from the surgery unit. Innovations in minimally invasive surgery are reducing hospital length of stay, decreasing complication rates, and enabling quicker recovery for patients. High demand for new implant technologies from healthcare providers to improve efficiency and patient satisfaction will contribute to high growth in the global dental implant market as demand rises.

High Implant Costs, Complex Regulatory Approvals, And Inconsistent Reimbursement Frameworks Significantly Restrain the Spinal Implants Market.

Complex product classifications, extensive preclinical testing and cumbersome multi-step regulatory approval processes can delay market access and raise the costs of compliance.

Many geographies have limited or variable reimbursement policies on advanced motion-preserving and minimally invasive spinal implants, which restricts patients’ access to premium technology. Such expenses and regulatory burdens also create a competitive disadvantage for incumbents and new players alike in terms of scaling and geography. Against this backdrop, pricing pressures and regulatory challenges will therefore continue to be important factors for industry participants to bear in mind in the future.

Major Spinal Implants Market Companies Analysis Listed in the Report are

- Medtronic

- Johnson & Johnson (DePuy Synthes)

- Stryker

- NuVasive

- Globus Medical

- Zimmer Biomet

- Alphatec Spine

- Orthofix International

- B. Braun Melsungen AG

- RTI Surgical

- SeaSpine Holdings Corporation

- Ulrich GmbH & Co. KG

- Spineart

- Aesculap Implant Systems

- VB Spine, LLC

- Centinel Spine, LLC

- K2M Group Holdings

- Amedica (CTL Amedica)

- Xtant Medical Holdings

- SpineGuard

Need Any Customization Research on Spinal Implants Market, Enquire Now: https://www.snsinsider.com/enquiry/9024

Segmentation Analysis:

By Product Type

Fusion Devices held the largest market share of 38.46% in 2025 with a long history of use in spine stabilization, high outcome rates for degenerative conditions treatment and high degree of clinical acceptance from surgeons. Artificial Discs are expected to grow at the fastest CAGR of 7.24% during 2026–2033 on account of the need for motion-preservation systems that limit adjacent segment degeneration.

By Device Type

Lumbar dominated with a 41.18% share in 2025 since the disorders of lumbar spine are most common among geriatric and non-active population. Cervical is anticipated to record the fastest CAGR of 7.12% through 2026–2033 driven by increasing prevalence of neck related spinal disorders and developments in minimally invasive cervical surgery.

By Surgery Type

Open Surgery accounted for the largest share of 55.23% in 2025 due to its long-standing clinical use, standardized procedural protocols, and widespread usage in complex spine cases. Minimally Invasive Surgery is forecasted to register the fastest CAGR of 7.03% during 2026–2033 owing to increasing need for faster recovery time, lesser blood loss and lower rate of complications.

By Material

Titanium held the largest share of 47.89% in 2025 with titanium’s high strength, biocompatibility and long-term clinical success for spinal fusion and stabilization. PEEK is expected to grow at the fastest CAGR of 7.18% during 2026–2033 owing to its radiolucency, flexibility and ability to be used in minimally invasive techniques.

By End User

Hospitals dominated with a 62.34% share in 2025 due to presence of infrastructure, skilled surgeons and increasing number of patients in need for complex spinal surgeries. Ambulatory Surgical Centers are anticipated to record the fastest CAGR of 7.05% through 2026–2033 spurred by patient interest in minimally invasive procedures on an outpatient basis and recoveries that are less expensive and shorter.

Regional Insights:

With a 41.57% market share in 2025, North America led the spinal implants market. The APAC region’s supremacy is a result of its advanced surgical techniques, high healthcare infrastructure, and rising rates of degenerative spine illnesses.

The fastest-growing region is the Asia-Pacific Spinal Implants Market, which is expected to increase at a compound annual growth rate (CAGR) of 7.16% from 2026 to 2033. The rising incidence of degenerative spine illnesses, the aging of the population, and the rising use of minimally invasive and motion-preserving operations in China, India, Japan, and South Korea are the main drivers of growth.

Recent Developments:

- In February 2025, Medtronic launched the CD Horizon™ ModuLeX™ Spinal System, enhancing its AiBLE™ ecosystem with modular screws, improved 3D visualization, and customizable constructs for complex spinal deformity procedures, boosting surgical flexibility and patient outcomes.

- In March 2025, DePuy Synthes expanded its spine portfolio at AAOS 2025, introducing advanced implants and data-driven surgical technologies, reinforcing its digital-orthopaedics strategy and improving precision in spinal fusion and minimally invasive procedures.

Purchase Single User PDF of Spinal Implants Market Report (20% Discount): https://www.snsinsider.com/checkout/9024

Exclusive Sections of the Report (The USPs):

- PRODUCT PERFORMANCE & CLINICAL OUTCOME METRICS – helps you evaluate average implant lifespan by material type, surgical success rates, revision surgery frequency, hospital stay duration, and adoption rates across different spinal regions.

- TECHNOLOGICAL ADOPTION & INNOVATION INDEX – helps you analyze the share of implants with advanced biomaterials or surface coatings, adoption of robotic-assisted and image-guided surgeries, percentage of minimally invasive procedures using next-generation implants, and annual patent activity.

- R&D INVESTMENT & PIPELINE STRENGTH – helps you assess average R&D expenditure per manufacturer and measure innovation intensity driving product differentiation and long-term competitive advantage.

- MANUFACTURING & SUPPLY CHAIN EFFICIENCY METRICS – helps you understand average production lead times, supplier concentration for critical materials like titanium and PEEK, defect or recall rates, and inventory turnover efficiency.

- COST STRUCTURE & PRICING BENCHMARKS – helps you evaluate the average cost per implant by material and design, enabling margin analysis and pricing strategy assessment across regions.

- REGULATORY & COMPLIANCE PERFORMANCE INDICATORS – helps you track approval rates in major markets (FDA, CE, etc.), compliance with ISO and ASTM standards, post-market surveillance frequency, adverse event incidence rates, and inspection compliance across manufacturing sites.

- COMPETITIVE LANDSCAPE & STRATEGIC POSITIONING – helps you gauge the competitive strength of key spinal implant manufacturers based on product portfolio breadth, innovation pipeline, geographic reach, partnerships with healthcare institutions, and recent regulatory approvals or product launches.

Browse Other Reports

Pulmonary Arterial Hypertension Market Report

Laboratory Equipment Market Report

Periodontal Therapeutics Market Report

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.