— Net sales increase driven by recovery across all procedural segments and continued strong international growth —

— Pulse platform clinical evaluations underway in Europe following latest CE certification —

— Company provides full-year 2021 financial guidance —

SAN DIEGO, July 28, 2021 /PRNewswire/ — NuVasive, Inc. (NASDAQ: NUVA), the leader in spine technology innovation, focused on transforming spine surgery with minimally disruptive, procedurally integrated solutions, today announced financial results for the quarter ended June 30, 2021.

Second Quarter 2021 Highlights

- Net sales increased 44.8% to $294.8 million, or 43.3% on a constant currency basis;

- GAAP operating margin of 3.6%; Non-GAAP operating margin of 13.9%; and

- GAAP diluted earnings per share of $0.03; Non-GAAP diluted earnings per share of $0.60.

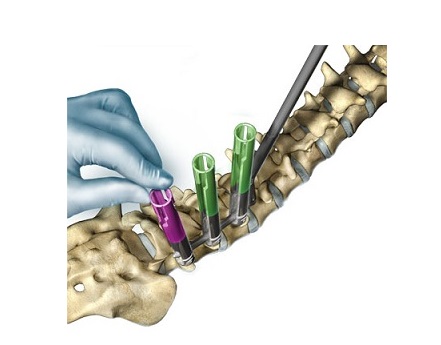

“NuVasive continued to see the spine market stabilize throughout the second quarter, providing us the opportunity to help more surgeons and patients around the globe. Our continued investments in the cervical and anterior procedural segments and our international commercial organization are advancing both our near- and long-term growth strategy,” said J. Christopher Barry, chief executive officer of NuVasive. “Following our latest CE certification, the Pulse platform clinical evaluations and surgeon feedback have exceeded our expectations. The ability for multiple technologies to be utilized in a single, integrated platform enables surgeons to increase surgical reproducibility—a pivotal step in how NuVasive is transforming spine surgery.”

A full reconciliation of GAAP to non-GAAP financial measures can be found in the tables of this news release.

Second Quarter 2021 Results

NuVasive reported second quarter 2021 total net sales of $294.8 million, a 44.8% increase compared to $203.6 million for the second quarter 2020. On a constant currency basis, second quarter 2021 total net sales increased 43.3% compared to the same period last year. The net sales results were due to recovery from the COVID-19 pandemic across all procedural segments and continued strong international growth.

For the second quarter 2021, GAAP gross profit was $216.5 million or $217.1 million on a non-GAAP basis, compared to GAAP and non-GAAP gross profit of $123.1 million in the prior year period. GAAP gross margin was 73.4% or 73.6% on a non-GAAP basis, compared to GAAP and non-GAAP gross margin of 60.5% in the prior year period. GAAP and non-GAAP gross profit improvement was primarily driven by incremental inventory reserves taken in the second quarter of 2020 resulting from pandemic-related impacts.

For the second quarter 2021, GAAP net income was $1.8 million or diluted earnings per share of $0.03, compared to GAAP net loss of $50.0 million or diluted loss per share of $0.98 in the prior year period. Non-GAAP net income was $31.2 million or diluted earnings per share of $0.60, compared to non-GAAP net loss of $20.4 million or diluted loss per share of $0.40 in the prior year period.

Cash, cash equivalents, and investments were $204.1 million as of June 30, 2021. In April 2021, the Simplify® Cervical Disc received approval from the U.S. Food and Drug Administration for two-level cervical total disc replacement, resulting in the payment of $45.8 million for the achievement of this regulatory milestone.

2021 Financial Guidance

Today, NuVasive announced full-year 2021 financial guidance. Please see our Reconciliation of Non-GAAP Financial Guidance included in this release for a reconciliation of the GAAP and non-GAAP financial measures. For full-year 2021, the Company expects:

- Net sales in the range of $1.19 billion to $1.21 billion;

- Non-GAAP operating margin in the range of 14.4% to 14.9%; and

- Non-GAAP diluted earnings per share in the range of $2.25 to $2.35.

Supplementary Financial Information

For additional financial detail, please visit the Investor Relations section of the Company’s website at www.nuvasive.com to access Supplementary Financial Information.

Reconciliation of GAAP to Non-GAAP Information

Management uses certain non-GAAP financial measures such as non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating margin, non-GAAP net income (loss), and non-GAAP diluted earnings (loss) per share. These non-GAAP financial measures exclude amortization of intangible assets, business transition costs, purchased in-process research and development, one-time restructuring, non-cash purchase accounting adjustments, certain foreign currency impacts and related items in connection with acquisitions, investments and divestitures, certain litigation expenses and settlements, certain European medical device regulation costs, gains and losses from strategic investments, gains and losses from changes in fair value of derivatives, non-cash interest expense (excluding debt issuance cost) and other significant one-time items. Management also uses certain non-GAAP measures which are intended to exclude the impact of foreign exchange currency fluctuations. The measure constant currency utilizes an exchange rate that eliminates fluctuations when calculating financial performance numbers. The Company also uses measures such as free cash flow, which represents cash flow from operations less cash used in the acquisition and disposition of capital. Additionally, the Company uses an adjusted EBITDA measure which represents earnings before interest, taxes, depreciation and amortization and excludes the impact of stock-based compensation, business transition costs, purchased in-process research and development, one-time restructuring, non-cash purchase accounting adjustments, certain foreign currency impacts and related items in connection with acquisitions, investments and divestitures, certain litigation expenses and settlements, certain European medical device regulation costs, gains and losses on strategic investments, gains and losses from changes in fair value of derivatives and other significant one-time items.

Management calculates the non-GAAP financial measures provided in this earnings release excluding these costs and uses these non-GAAP financial measures to enable it to further and more consistently analyze the period-to-period financial performance of its core business operations. Management believes that providing investors with these non-GAAP measures gives them additional information to enable them to assess, in the same way management assesses, the Company’s current and future continuing operations. These non-GAAP measures are not in accordance with, or an alternative for, GAAP, and may be different from non-GAAP measures used by other companies. Set forth below are reconciliations of the non-GAAP financial measures to the comparable GAAP financial measure.