Company plans to realign in an effort to improve efficiencies, while lowering its capital requirements to invest in innovation; estimated cash savings in 2023 are expected to be approximately $30 – $35 million

DEERFIELD, Ill., Nov. 09, 2022 (GLOBE NEWSWIRE) — Surgalign Holdings, Inc. (NASDAQ: SRGA), a global medical technology company focused on elevating the standard of care by driving the evolution of digital health, today announced that its Board of Directors has approved a corporate restructuring plan intended to help drive growth in the most valuable and profitable parts of the Company’s business.

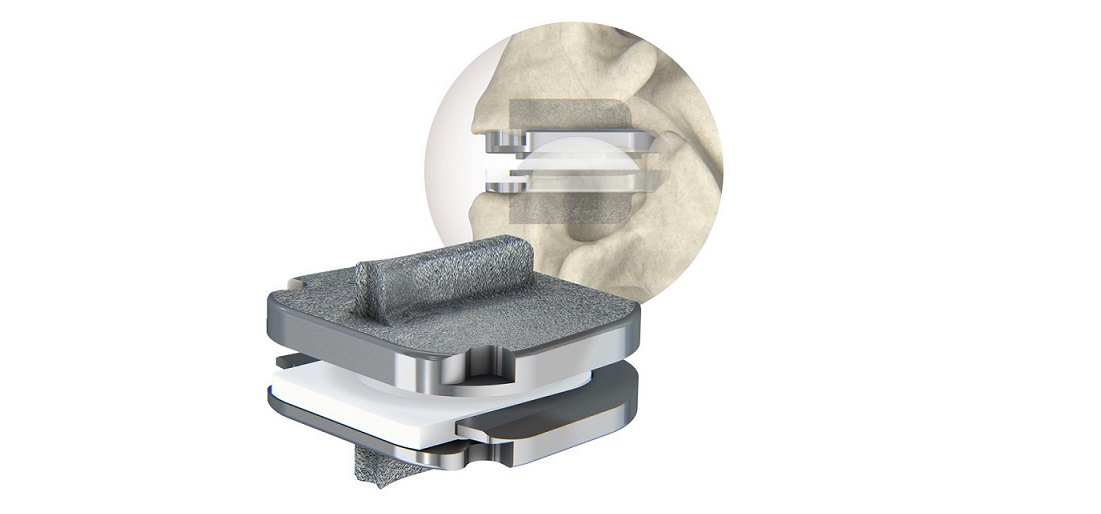

As part of the plan approved on November 8, 2022, Surgalign intends to continue its brand and product rationalization programs, which are expected to result in a greater focus on new products brought to market over the past year and core hardware products that hold the greatest growth prospects. Throughout the fourth quarter of 2022 and into early 2023, the Company intends to discontinue some of its lower performing SKUs, which will enable the redeployment of resources across research and development and support the commercialization of products that align with the go-forward business strategy.

Additionally, as part of its focus to improve operational efficiencies, the Company intends to continue ongoing efforts, as well as initiate several new programs designed to streamline and optimize resources and lower future working capital requirements. This will include product rationalization, process improvements and organizational redesign programs, which the Company expects will result in lower non-essential spending, particularly in general and administrative expenses and select capital expenditures. As a result of the restructuring programs and initiatives planned, the Company expects an estimated cash savings of approximately $30.0 to $35.0 million compared to 2022. The Company also disclosed that its Board of Directors has approved the exploration of further restructuring initiatives, which include but are not limited to, the potential paring down, selling or exiting certain aspects of its business, both domestically and abroad.

Terry Rich, President and Chief Executive Officer of Surgalign, stated, “We intend to take aggressive steps to realign our business and improve our market position and value creation opportunities. Our focus is on innovation and better serving our customers with the products and support they need to improve patient outcomes. We believe these programs will enable us to generate growth in areas we are focused on, enhance gross margins and lower expenses, and over time, improve our financial position by freeing up resources to invest in areas we believe hold the greatest promise. Implementation of these programs will be dependent on the outcome of financing initiatives currently underway.”

To achieve these savings, the Company expects to incur approximately $3.0 – $3.5 million in employee-related severance costs and $2.5 – $3.5 million in other exit and disposal costs in the fourth quarter of 2022 and first quarter of 2023 for a total estimated restructuring cost of approximately $5.5 – $7.0 million. Estimated cash savings are expected to be realized throughout 2023 and programs are anticipated to begin late in the fourth quarter of 2022 and be substantially complete in the first half of 2023. The Company continues to evaluate and identify other areas of its business to enhance efficiencies and improve processes, with a goal to further lower its operating expenses and capital needs.

About Surgalign Holdings, Inc.

Surgalign Holdings, Inc. is a global medical technology company committed to the promise of digital health to drive transformation across the surgical landscape. Uniquely aligned and resourced to advance the standard of care, the company is building technologies physicians and other health providers will look to for what is truly possible for their patients. Surgalign is focused on developing solutions that predictably deliver superior clinical and economic outcomes. Surgalign markets products throughout the United States and in approximately 50 countries worldwide through an expanding network of top independent distributors. Surgalign is headquartered in Deerfield, IL, with commercial, innovation and design centers in San Diego, CA, Warsaw and Poznan, Poland, and Wurmlingen, Germany. Learn more at www.surgalign.com and connect on LinkedIn and Twitter.

Forward Looking Statement

This press release contains forward-looking statements based on management’s current expectations, estimates and projections about our industry, our management’s beliefs and certain assumptions made by our management, and such forward-looking statements include (among others) statements regarding anticipated future financial and operating performance (including forecasted full-year revenue and number of HOLO sites secured), product rationalization and expense reduction initiatives and the results thereof, potential third party financing and anticipated cash needs. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking statements. The forward-looking statements are not guarantees of future performance and are based on certain assumptions including general economic conditions, as well as those within the Company’s industry, and numerous other factors and risks identified in the Company’s most recent Form 10-K, 10-Q and other filings with the SEC. Our actual results may differ materially from the anticipated results reflected in these forward-looking statements. Important factors that could cause actual results to differ materially from the anticipated results reflected in these forward-looking statements include risks and uncertainties relating to the following: (i) the Company’s access to adequate operating cash flow, trade credit, borrowed funds and equity capital to fund its operations and pay its obligations as they become due, and the terms on which external financing may be available, including the impact of adverse trends or disruption in the global credit and equity markets; (ii) risks relating to existing or potential litigation or regulatory actions; (iii) the identification of control deficiencies, including material weaknesses in internal control over financial reporting; (iv) general worldwide economic conditions and related uncertainties; (v) the continued impact of the COVID-19 and the Company’s attempts at mitigation, particularly in international markets served by the Company; (vi) the failure by the Company to identify, develop and successfully implement its strategic initiatives, particularly with respect to its digital surgery strategy; (vii) the reliability of our supply chain; (viii) our ability to meet obligations, including purchase minimums, under our vendor and other agreements; (ix) whether or when the demand for procedures involving our products will increase; (x) our financial position and results, total revenue, product revenue, gross margin, and operations; (xi) failure to realize, or unexpected costs in seeking to realize, the expected benefits of the Holo Surgical Inc. (“Holo Surgical”) and Inteneural Networks Inc. (“INN”) acquisitions, including the failure of Holo Surgical’s and INN’s products and services to be satisfactorily developed or achieve applicable regulatory approvals or as a result of the failure to commercialize and distribute its products; (xii) the failure to effectively integrate Holo Surgical’s and INN’s operations with those of the Company, including: retention of key personnel; the effect on relationships with customers, suppliers, and other third parties; and the diversion of management time and attention to the integration; (xiii) the number of shares and amount of cash that will be required in connection with any post-closing milestone payments, including as a result of changes in the trading price of the Company’s common stock and their effect on the amount of cash needed by the Company to fund any post-closing milestone payments in connection with the acquisitions; (xiv) the continuation of recent quality issues with respect to our global supply chain; (xv) the effect and timing of changes in laws or in governmental regulations; and (xvi) other risks described in our public filings with the SEC. These factors should be considered carefully, and undue reliance should not be placed on the forward-looking statements. Each forward-looking statement in this communication speaks only as of the date of the particular statement. Copies of the Company’s SEC filings may be obtained by contacting the Company or the SEC or by visiting Surgalign’s website at http://www.surgalign.com/ or the SEC’s website at http://www.sec.gov/. We undertake no obligation to update these forward-looking statements except as may be required by law.

| Investor and Media Contact: | Surgalign Contact: |

| Glenn Wiener | Kristine Simmons |

| gwiener@gwcco.com | ksimmons@surgalign.com |

| +1 917 887 8434 | +1 619 206 4648 |