November 15, 2022

RICHARDSON, Texas–(BUSINESS WIRE)– Fuse Medical, Inc. (OTCPINK: FZMD) (“Fuse” or the “Company”) an emerging manufacturer and distributor of innovative medical devices for the orthopedic and spine marketplace, announced for its third quarter ended September 30, 2022 and that it has filed its quarterly report on Form 10-Q for the quarter ended September 30, 2022 with the Securities and Exchange Commission (“SEC”) on November 14, 2022.

Third Quarter 2022 Financial Highlights

- Net revenues for the quarter ended September 30, 2022 were $4.5 million, compared to $4.2 million for the quarter ended September 30, 2021 which was an increase of approximately 7%.

- For the quarter ended September 30, 2022, gross profit was $3 million, or 67% of revenues, compared to $2.3 million, or 56% of revenues, for the quarter ended September 30, 2021 which was an increase of 11%.

- Selling, general, administrative, and other expenses (“SG&A”) for the quarter ended September 30, 2022 was approximately $1.7 million compared to $1.5 million for the quarter ended September 30, 2021.

- Commissions expense for the quarter ended September 30, 2022 decreased to $1.2 million from $1.4 million for the quarter ended September 30, 2021, a decrease of approximately $276,409.

- For the quarter ended September 30, 2022, net loss was $9,376 compared to $697,036 for the quarter ended September 30, 2021, reflecting a reduction in our net loss of $687,660 or approximately 99%.

- For the quarter ended September 30, 2022, Adjusted EBITDA was $131,241 compared to Adjusted EBITDA loss of $630,549 for the quarter ended September 30, 2021, reflecting a reduction in our Adjusted EBITDA loss of $761,790 or approximately 121%.

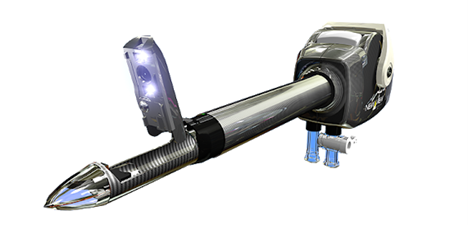

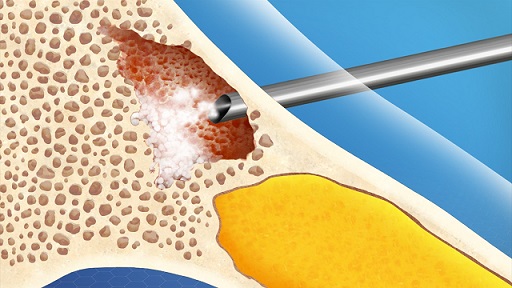

Christopher C. Reeg, Chief Executive Officer of Fuse Medical, commented, “We are pleased with our third quarter performance, as highlighted by a 7% increase in revenue, an 11% increase in gross profit, and a 121% increase in EBITDA over the prior-year period. Our implementation and achievement of strategic initiatives, which includes increasing our portfolio of Fuse branded and manufactured products, is evidenced by the third quarter initial launch of the Fuse PSS Pedicle Screw System with minimally invasive options, and reflected in our third quarter results.”

Mr. Reeg further added, “Our growth for the remainder of 2022, and into 2023 is focused on continued design and development of unique medical devices for commercialization, new product launches in the orthopedics and spine marketplace, investing in our direct sales force, and expansion of our national distribution footprint. We expect the execution of these strategic initiatives to drive growth in the near term, while increasing our visibility as an emerging manufacturer of relevant medical devices.”

About Fuse Medical, Inc.

Fuse is an emerging manufacturer and distributor of innovative medical devices for the orthopedic and spine marketplace. We provide a comprehensive portfolio of products in the orthopedic total joints, sports medicine, trauma, foot and ankle space, as well as, degenerative and deformity spine, osteobiologics, wound care, and regenerative products. For more information about the Company, or if you’re interested in becoming a distributor of any Fuse’s products, please contact us at info@fusemedical.com or visit: www.fusemedical.com.

Forward Looking Statements

Certain statements in this press release, constitute “forward-looking statements” within the meaning of the federal securities laws. Words such as “may,” “might,” “will,” “should,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” “predict,” “forecast,” “project,” “plan,” “intend,” or similar expressions or statements regarding intent, belief, or current expectations, are forward-looking statements. While the Company believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based only on information available to the Company as of the date of this release. These forward-looking statements are based upon current estimates and assumptions and are subject to various risks and uncertainties, including, without limitation, those set forth in the Company’s filings with the Securities and Exchange Commission; the failure of the Company to close the transaction; and integration issues with the consolidated company. Thus, actual results could be materially different. The Company expressly disclaims any obligation to update or alter statements whether as a result of new information, future events, or otherwise, except as required by law.

Note Regarding Use of Non-GAAP Financial Measurements:

The financial data contained in this press release includes certain non-GAAP financial measures as defined by the Securities and Exchange Commission (“SEC”), including “Adjusted EBITDA”. The Company is presenting Adjusted EBITDA because it believes that it provides useful information to investors about Fuse, its business and its financial condition. The Company defines Adjusted EBITDA as net income or loss from continuing operations before the effects of interest expense, taxes, depreciation and amortization, and excludes certain non-recurring and non-cash items. The Company believes Adjusted EBITDA is useful to investors because it is one of the measures used by the Company’s Board of Directors and management to evaluate its business, including in internal management reporting, budgeting and forecasting processes, in comparing operating results across the business, as an internal profitability measure, as a component in evaluating the ability and the desirability of making capital expenditures and significant acquisitions, and as an element in determining executive compensation.

However, Adjusted EBITDA is not a measure of financial performance under generally accepted accounting principles in the United States of America (“GAAP”), and the items excluded from Adjusted EBITDA are significant components in understanding and assessing financial performance. Therefore, Adjusted EBITDA should not be considered a substitute for net income (loss) or cash flows from operating, investing, or financing activities. Because Adjusted EBITDA is calculated before recurring cash charges including interest expense and taxes, and is not adjusted for capital expenditures or other recurring cash requirements of the business, it should not be considered as a measure of discretionary cash available to invest in the growth of the business. There are a number of material limitations to the use of Adjusted EBITDA as an analytical tool, including the following:

- Adjusted EBITDA does not reflect the Company’s interest expense;

- Adjusted EBITDA does not reflect the Company’s tax expense or the cash requirements to pay its taxes; and

- Although depreciation and amortization are non-cash expenses in the period recorded, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect the cash requirements for such replacement.

The Company compensates for these limitations by relying primarily on its GAAP financial measures and by using Adjusted EBITDA only as supplemental information. The Company believes that consideration of Adjusted EBITDA, together with a careful review of its GAAP financial measures, is the most informed method of analyzing Fuse Medical, Inc.

The Company reconciles Adjusted EBITDA to net income, and that reconciliation is set forth below. Because Adjusted EBITDA is not a measurement determined in accordance with GAAP and is susceptible to varying calculations, Adjusted EBITDA, as presented, may not be comparable to other similarly titled measures of other companies. Revenues and expenses are measured in accordance with the policies and procedures described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021.