Dublin, Jan. 30, 2023 (GLOBE NEWSWIRE) — The “Arthroscopy Devices Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027” report has been added to ResearchAndMarkets.com’s offering.

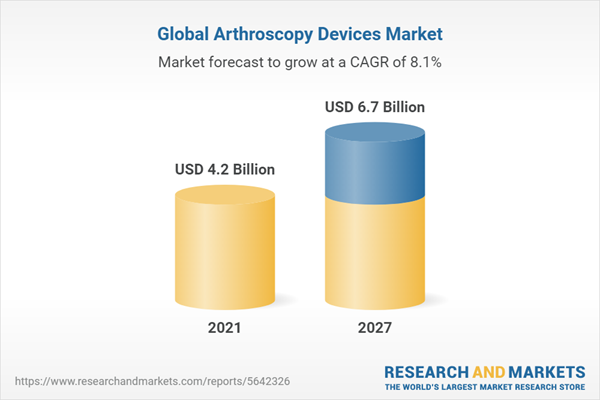

The global arthroscopy devices market size reached US$ 4.2 Billion in 2021. Looking forward, the publisher expects the market to reach US$ 6.7 Billion by 2027, exhibiting a CAGR of 8.09% during 2021-2027.

Keeping in mind the uncertainties of COVID-19, we are continuously tracking and evaluating the direct as well as the indirect influence of the pandemic on different end use sectors. These insights are included in the report as a major market contributor.

Arthroscopy devices refer to various medical equipment and tools that are used to visualize, examine and conduct therapeutic interventions inside various joints of the body.

They are primarily used for the treatment of medical conditions, such as osteoarthritis, rheumatoid arthritis, tendonitis and bone tumor. Some of the commonly used devices during arthroscopy include arthroscope, implants, fluid management systems, radiofrequency systems, visualization systems, etc.

These devices are usually attached with a small lens and are inserted into the patient’s body to examine the structures and abnormalities inside the joints. These devices find extensive application in the arthroscopy of the knee, hip, spine, ankle, shoulder, elbow, wrist and jaw.

The increasing prevalence of bone-related and musculoskeletal disorders is one of the key factors driving the growth of the market. Furthermore, the rising geriatric population across the globe that is more susceptible to such ailments is also providing a boost to the market growth.

There is an increasing preference for minimally invasive (MI) treatment procedures among the masses, which has led to the rising adoption of arthroscopy devices.

Additionally, various innovations in the field of sports medicine and the development of technologically advanced product variants are also creating a positive outlook for the market. Product manufacturers are developing advanced arthroscopic devices to improve visualization with high-definition (HD) cameras, superior suturing techniques and customized suturing materials.

Other factors, including rising health consciousness and awareness regarding the available treatment alternatives, along with the improving healthcare infrastructure, are projected to drive the market further.

Competitive Landscape:

The report has also analysed the competitive landscape of the market with some of the key players being Arthrex Inc., CONMED Corporation, Johnson & Johnson Services Inc, Karl Storz SE & Co. KG, Medtronic Inc., Richard Wolf GmbH, Smith & Nephew plc, Stryker Corporation, Vimex Sp. z o.o., Zimmer Biomet Holdings Inc., etc.

Key Questions Answered in This Report:

- How has the global arthroscopy devices market performed so far and how will it perform in the coming years?

- What are the key regional markets?

- What has been the impact of COVID-19 on the global arthroscopy devices market?

- What is the breakup of the market based on the device type?

- What is the breakup of the market based on the arthroscopy type?

- What is the breakup of the market based on the end-user?

- What arae the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the global arthroscopy devices market and who are the key players?

- What is the degree of competition in the industry?

| Report Attribute | Details |

| No. of Pages | 142 |

| Forecast Period | 2021 – 2027 |

| Estimated Market Value (USD) in 2021 | $4.2 Billion |

| Forecasted Market Value (USD) by 2027 | $6.7 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

Key Topics Covered:

1 Preface

2 Scope and Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Arthroscopy Devices Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Device Type

6.1 Arthroscope

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Arthroscopic Implant

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Fluid Management System

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Radiofrequency System

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Visualization System

6.5.1 Market Trends

6.5.2 Market Forecast

6.6 Others

6.6.1 Market Trends

6.6.2 Market Forecast

7 Market Breakup by Arthroscopy Type

7.1 Knee Arthroscopy

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Hip Arthroscopy

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Spine Arthroscopy

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Shoulder and Elbow Arthroscopy

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Foot and Ankle Arthroscopy

7.5.1 Market Trends

7.5.2 Market Forecast

7.6 Others

7.6.1 Market Trends

7.6.2 Market Forecast

8 Market Breakup by End-User

8.1 Hospitals

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Ambulatory Surgical Centers

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Orthopedic Clinics

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Others

8.4.1 Market Trends

8.4.2 Market Forecast

9 Market Breakup by Region

10 SWOT Analysis

11 Value Chain Analysis

12 Porters Five Forces Analysis

13 Price Indicators

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Arthrex Inc.

14.3.1.1 Company Overview

14.3.1.2 Product Portfolio

14.3.1.3 SWOT Analysis

14.3.2 CONMED Corporation

14.3.2.1 Company Overview

14.3.2.2 Product Portfolio

14.3.2.3 Financials

14.3.2.4 SWOT Analysis

14.3.3 Johnson & Johnson Services Inc.

14.3.3.1 Company Overview

14.3.3.2 Product Portfolio

14.3.3.3 Financials

14.3.3.4 SWOT Analysis

14.3.4 Karl Storz SE & Co. KG

14.3.4.1 Company Overview

14.3.4.2 Product Portfolio

14.3.4.3 Financials

14.3.4.4 SWOT Analysis

14.3.5 Medtronic Inc.

14.3.5.1 Company Overview

14.3.5.2 Product Portfolio

14.3.6 Richard Wolf GmbH

14.3.6.1 Company Overview

14.3.6.2 Product Portfolio

14.3.6.3 Financials

14.3.6.4 SWOT Analysis

14.3.7 Smith & Nephew Plc

14.3.7.1 Company Overview

14.3.7.2 Product Portfolio

14.3.7.3 Financials

14.3.7.4 SWOT Analysis

14.3.8 Stryker Corporation

14.3.8.1 Company Overview

14.3.8.2 Product Portfolio

14.3.8.3 Financials

14.3.8.4 SWOT Analysis

14.3.9 Vimex Sp. z o.o.

14.3.9.1 Company Overview

14.3.9.2 Product Portfolio

14.3.10 Zimmer Biomet Holdings Inc.

14.3.10.1 Company Overview

14.3.10.2 Product Portfolio

14.3.10.3 Financials

14.3.10.4 SWOT Analysis

For more information about this report visit https://www.researchandmarkets.com/r/fbd8sn