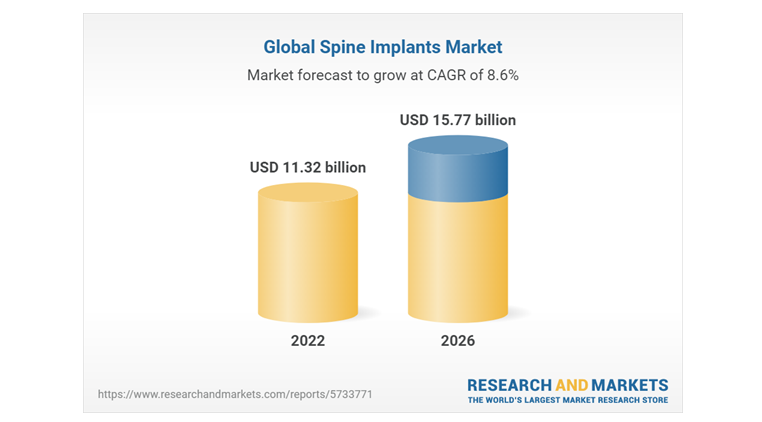

BELGRADE, Mont., March 07, 2023 (GLOBE NEWSWIRE) — Xtant Medical Holdings, Inc. (NYSE American: XTNT), a global medical technology company focused on surgical solutions for the treatment of spinal disorders, today reported financial and operating results for the fourth quarter and year ended December 31, 2022.

“Highlighted by strong fourth quarter revenue results and last week’s acquisition of the Coflex® product line, we are executing on our key growth initiatives,” said Sean Browne, President and CEO of Xtant Medical. “We continue to generate robust demand for our biologics products, which grew 14% for the quarter, and improve our operating efficiencies by increasing our production capacity that now has us well-positioned to sustain our momentum in 2023. Additionally, with the addition of the Coflex product line, we significantly enhanced our fixation offering at ASCs and outpatient facilities. We are excited to add proven treatment devices while expanding our commercial team and distributor network, all of which are core focus areas to our long-term growth strategy.”

Fourth Quarter and Full Year 2022 Financial Results

Fourth quarter 2022 revenue grew 9% to $15.3 million, compared to $14.0 million for the same quarter in 2021. Full year 2022 revenue was $58.0 million, compared to $55.3 million for 2021. The increase in revenue was largely attributable to our new products.

Gross margin for the fourth quarter of 2022 was 54.4%, compared to 55.1% for the same period in 2021 and 55.4% for the full year 2022, compared to 58.8% for the full year 2021. These decreases were primarily attributable to higher production costs with increased charges for excess and obsolete inventory also contributing to the full year decline.

Operating expenses for the fourth quarter of 2022 totaled $10.0 million, compared to $9.6 million for the fourth quarter of 2021, and were $38.9 million for the full year 2022 compared to $36.3 million for the full year 2021. The increase for the quarterly comparison was primarily due to higher independent agent commission expenses. The increase for the annual comparison was primarily due to higher independent agent commission expenses and employee compensation expenses as well as costs related to ERP system upgrades, partially offset by lower legal settlement expenses.

Fourth quarter 2022 net loss totaled $2.2 million, or $0.02 per share, compared to the fourth quarter 2021 net loss of $2.3 million, or $0.03 per share. Net loss for 2022 was $8.5 million, or $0.09 per share, compared to a net loss of $4.8 million, or $0.06 per share, for 2021.

Non-GAAP Adjusted EBITDA for the fourth quarter of 2022 totaled a loss of $0.8 million, compared to Non-GAAP Adjusted EBITDA loss of $0.9 million for the same period in 2021. Non-GAAP Adjusted EBITDA for 2022 totaled a loss of $3.0 million, compared to a gain of $0.3 million for 2021. The Company defines Adjusted EBITDA as net income/loss from operations before depreciation, amortization and interest expense and provision for income taxes, and as further adjusted to add back in or exclude, as applicable, non-cash compensation and legal settlement reserves. A calculation and reconciliation of Adjusted EBITDA to net loss can be found in the attached financial tables.

Conference Call

Xtant Medical will host a webcast and conference call to discuss the fourth quarter and full year 2022 financial results on Tuesday, March 7, 2023 at 9:00 AM ET. To access the webcast, Click Here. To access the conference call, dial 877-407-6184 within the U.S. or 201-389-0877 outside the U.S. A replay of the call will be available at www.xtantmedical.com, under “Investor Info.”

About Xtant Medical Holdings, Inc.

Xtant Medical Holdings, Inc. (www.xtantmedical.com) is a global medical technology company focused on the design, development, and commercialization of a comprehensive portfolio of orthobiologics and spinal implant systems to facilitate spinal fusion in complex spine, deformity and degenerative procedures. Xtant people are dedicated and talented, operating with the highest integrity to serve our customers.

The symbols ™ and ® denote trademarks and registered trademarks of Xtant Medical Holdings, Inc. or its affiliates, registered as indicated in the United States, and in other countries. All other trademarks and trade names referred to in this release are the property of their respective owners.

Non-GAAP Financial Measures

To supplement the Company’s consolidated financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP), the Company uses certain non-GAAP financial measures in this release, including Adjusted EBITDA. Reconciliations of the non-GAAP financial measures used in this release to the most comparable GAAP measures for the respective periods can be found in tables later in this release. The Company’s management believes that the presentation of these measures provides useful information to investors. These measures may assist investors in evaluating the Company’s operations, period over period. Management uses the non-GAAP measures in this release internally for evaluation of the performance of the business, including the allocation of resources. Investors should consider non-GAAP financial measures only as a supplement to, not as a substitute for or as superior to, measures of financial performance prepared in accordance with GAAP.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “intends,” ‘‘expects,’’ ‘‘anticipates,’’ ‘‘plans,’’ ‘‘believes,’’ ‘‘estimates,’’ “continue,” “future,” ‘‘will,’’ “potential,” “going forward,” similar expressions or the negative thereof, and the use of future dates. Forward-looking statements in this release include the Company’s belief that it is continuing to generate robust demand for its biologics products and improve its operating efficiencies by increasing its production capacity and is well-positioned to sustain its momentum in 2023. The Company cautions that its forward-looking statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others: the Company’s future operating results and financial performance; its ability to increase or maintain revenue; risks associated with its recent acquisition of the Coflex® product line; possible future impairment charges to long-lived assets and goodwill and write-downs of excess inventory if revenues continue to decrease; the ability to remain competitive; the ability to innovate, develop and introduce new products; the ability to engage and retain new and existing independent distributors and agents and qualified personnel and the Company’s dependence on key independent agents for a significant portion of its revenue; the effect of COVID-19, labor and hospital staffing shortages on the Company’s business, operating results and financial condition, especially when they affect key markets; the Company’s ability to implement successfully its future growth initiatives and risks associated therewith; the effect of inflation, increased interest rates and other recessionary factors and supply chain disruptions; the effect of product sales mix changes on the Company’s financial results; government and third-party coverage and reimbursement for Company products; the ability to obtain and maintain regulatory approvals and comply with government regulations; the effect of product liability claims and other litigation to which the Company may be subject; the effect of product recalls and defects; the ability to obtain and protect Company intellectual property and proprietary rights and operate without infringing the rights of others; the ability to service Company debt, comply with its debt covenants and access additional indebtedness; the ability to obtain additional financing on favorable terms or at all; and other factors. Additional risk factors are contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Securities and Exchange Commission (SEC) on March 7, 2023 and subsequent SEC filings by the Company. Investors are encouraged to read the Company’s filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The Company undertakes no obligation to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as required by law. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact

David Carey

Lazar FINN Partners

Ph: 212-867-1762

Email: david.carey@finnpartners.com