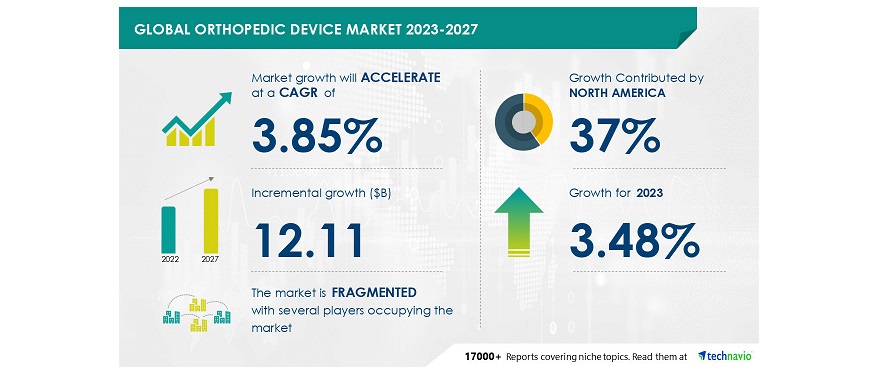

NEW YORK, June 23, 2023 /PRNewswire/ — The orthopedic device market is estimated to grow by USD 12.11 billion during 2022-2027, growing at a CAGR of 3.85%. North America is estimated to contribute 37% to the growth of the orthopedic devices market during the forecast period. This growth in the region is due to the high adoption of orthopedic devices and an increase in the number of surgical procedures. In addition, the growing number of spinal non-fusion procedures, adoption of technologically updated spinal implants, and growing future investments by vendors in clinical trials are driving market growth in this region. The advancement in technology by Medicare in the field of product design, application upgrades, and availability of reimbursements is also driving the development in the region. For Comprehensive details on the market size of the historical period(2017 to 2021) and forecast period (2023-2027) – View the Sample report

Vendor Landscape

The orthopedic device market is fragmented; the vendors are competing with competitors and are trying to get a greater market share. The market is growing, and the chances of new entrants cannot be overlooked. The major vendors have well-established economies of scale and market presence and generally rely on positioning technological advances, and the price of the products –The report provides a full list of key vendors, their strategies, and the latest developments. Buy Now

Market Dynamics

Major Drivers & Challenges

The increasing number of orthopedic disorders, trauma, and sports injuries is the key factor driving the market growth. This growth is due to craniomaxillofacial (CMF) procedures, an increase in the number of hip and knee replacement surgeries, and sports-related injuries. The advantages of replacement procedures such as restoring mobility, stabilizing weak bones, and lowering discomfort are becoming popular globally. These orthopedic devices are used to treat orthopedic conditions, such as osteoporosis, arthritis, trauma, back pain, and other emergency procedures. Hence, the rising prevalence of orthopedic disorders is one of the major factors driving the orthopedic devices market globally during the forecast period.

Rising product recalls by the vendors are the major challenges impeding market growth. The regulatory agencies continuously evaluate health hazards on each one to check for potential risks as these medical devices are prone to manufacturing errors. As a result, a lot of orthopedic implants and equipment have been taken off the market. For instance, Exactech hip implants, Medtronic Synergy Cranial, and StealthStation S7 Cranial software were the latest product recall in the market. Furthermore, labeling, specification, sterilization, and fractures are the major reasons the product recall.

The overall revenue of the company is affected by the product recall, and this is voluntarily done by the vendor itself or the US FDA issues a warning. Hence, these factors are expected to restrict the market’s growth during the forecast period.

Key Trends

New product launches coupled with R&D activities are the major trend in the market. The vendors are increasingly focusing on the development and launch of new orthopedic devices to compete with the players in the market. These launches are helping the vendors to penetrate the new market and enhance their growth. Furthermore, the new devices are specially customized implants, as per the patient’s anatomy, to reach the desired results post-surgery. To improve the efficacy of orthopedic-related implant procedures, the vendors are developing innovative devices. Hence, new product launches, coupled with vendors growing focus on R&D activities, are expected to drive the growth of the orthopedic devices market during the forecast period.

Technavio has identified key trends, drivers, and challenges in the market, which will help clients improve their strategies to stay ahead of their competitors. – View Sample Report

Company Profiles

The orthopedic device market report includes information on the product launches, sustainability, and prospects of leading vendors including aap Implantate AG, Alphatec Holdings Inc., B. Braun SE, Boston Scientific Corp., Colfax Corp., Conmed Corp., CTL Amedica Corp., Exactech Inc., Johnson and Johnson, Medacta International SA, Medtronic Plc, MicroPort Scientific Corp., Ossur hf, Smith and Nephew plc, Stryker Corp., TriMed Inc., Zimmer Biomet Holdings Inc., Arthrex Inc., Integra Lifesciences Holdings Corp., and Nuvasive Inc..

Competitive Analysis

The report includes competitive analysis, a proprietary tool to analyze and evaluate the position of companies based on their industry position score and market performance score. The competitive scenario categorizes companies based on various performance indicators. Some of the factors considered include the financial performance of companies over the past few years, growth strategies, product innovations, new product launches, investments, and growth in market share, among others.

Market Segmentation

This orthopedic device market is segmented by application (spine, knee, hip, extremities, and others), product (orthopedic implants and support devices and orthobiologics), and geography (North America, Europe, Asia, and the Rest of the World).

- The market share growth of the spine segment will be significant during the forecast period. The rise in spinal surgeries in the older population and the increasing number of clinical trials are the major factors driving the growth of this segment. Furthermore, the increase in the volume of artificial cervical discs and sacroiliac joint fusion, the rising popularity of artificial discs, motion preservation devices, and vertebral compression fracture devices are expected to positively impact the segment’s growth during the forecast period.

Gain instant access to 17,000+ market research reports.

Technavio’s SUBSCRIPTION platform

Related Reports

The pediatric medical devices market is estimated to grow at a CAGR of 8.84% between 2022 and 2027. The size of the market is forecast to increase by USD 15.01 billion. Furthermore, this report extensively covers market segmentation by end-user (hospitals, pediatric clinics, and others), product (in vitro diagnostic devices, cardiology devices, anesthesia and respiratory care devices, neonatal ICU devices, and others), and Geography (North America, Asia, Europe, and Rest of World (ROW)). The increasing prevalence of preterm birth is a key factor driving the growth of the market during the forecast period.

The diagnostic wearable medical devices market size is estimated to grow by USD 7,333.3 million at a CAGR of 15.2% between 2022 and 2027. Furthermore, this report extensively covers market segmentation applications (home healthcare, sports and fitness, and remote patient monitoring), device (vital signs monitors, sleep and activity monitors, fetal and obstetric monitoring devices, neuromonitoring devices, and ECG monitors), and geography (North America, Europe, Asia, and the Rest of World (ROW))

| Orthopedic Device Market Scope | |

| Report Coverage | Details |

| Base year | 2022 |

| Historic period | 2017-2021 |

| Forecast period | 2023-2027 |

| Growth momentum & CAGR | Accelerate at a CAGR of 3.85% |

| Market growth 2023-2027 | USD 12.11 billion |

| Market structure | Fragmented |

| YoY growth 2022-2023 (%) | 3.48 |

| Regional analysis | North America, Europe, APAC, and Rest of World (ROW) |

| Performing market contribution | North America at 37% |

| Key countries | US, China, Japan, Germany, and France |

| Competitive landscape | Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

| Key companies profiled | aap Implantate AG, Alphatec Holdings Inc., B. Braun SE, Boston Scientific Corp., Colfax Corp., Conmed Corp., CTL Amedica Corp., Exactech Inc., Johnson and Johnson, Medacta International SA, Medtronic Plc, MicroPort Scientific Corp., Ossur hf, Smith and Nephew plc, Stryker Corp., TriMed Inc., Zimmer Biomet Holdings Inc., Arthrex Inc., Integra Lifesciences Holdings Corp., and Nuvasive Inc. |

| Market dynamics | Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

| Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Table of contents

1 Executive Summary

- 1.1 Market Overview

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by Application

- Exhibit 06: Executive Summary – Chart on Market Segmentation by Product

- Exhibit 07: Executive Summary – Chart on Incremental Growth

- Exhibit 08: Executive Summary – Data Table on Incremental Growth

- Exhibit 09: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 10: Parent market

- Exhibit 11: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 12: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 13: Market segments

- 3.3 Market size 2022

- 3.4 Market outlook: Forecast for 2022-2027

- Exhibit 14: Chart on Global – Market size and forecast 2022-2027 ($ billion)

- Exhibit 15: Data Table on Global – Market size and forecast 2022-2027 ($ billion)

- Exhibit 16: Chart on Global Market: Year-over-year growth 2022-2027 (%)

- Exhibit 17: Data Table on Global Market: Year-over-year growth 2022-2027 (%)

4 Historic Market Size

- 4.1 Global orthopedic device market 2017 – 2021

- Exhibit 18: Historic Market Size – Data Table on Global orthopedic device market 2017 – 2021 ($ billion)

- 4.2 Application Segment Analysis 2017 – 2021

- Exhibit 19: Historic Market Size – Application Segment 2017 – 2021 ($ billion)

- 4.3 Product Segment Analysis 2017 – 2021

- Exhibit 20: Historic Market Size – Product Segment 2017 – 2021 ($ billion)

- 4.4 Geography Segment Analysis 2017 – 2021

- Exhibit 21: Historic Market Size – Geography Segment 2017 – 2021 ($ billion)

- 4.5 Country Segment Analysis 2017 – 2021

- Exhibit 22: Historic Market Size – Country Segment 2017 – 2021 ($ billion)

5 Five Forces Analysis

- 5.1 Five forces summary

- Exhibit 23: Five forces analysis – Comparison between 2022 and 2027

- 5.2 Bargaining power of buyers

- Exhibit 24: Chart on Bargaining power of buyers – Impact of key factors 2022 and 2027

- 5.3 Bargaining power of suppliers

- Exhibit 25: Bargaining power of suppliers – Impact of key factors in 2022 and 2027

- 5.4 Threat of new entrants

- Exhibit 26: Threat of new entrants – Impact of key factors in 2022 and 2027

- 5.5 Threat of substitutes

- Exhibit 27: Threat of substitutes – Impact of key factors in 2022 and 2027

- 5.6 Threat of rivalry

- Exhibit 28: Threat of rivalry – Impact of key factors in 2022 and 2027

- 5.7 Market condition

- Exhibit 29: Chart on Market condition – Five forces 2022 and 2027

6 Market Segmentation by Application

- 6.1 Market segments

- Exhibit 30: Chart on Application – Market share 2022-2027 (%)

- Exhibit 31: Data Table on Application – Market share 2022-2027 (%)

- 6.2 Comparison by Application

- Exhibit 32: Chart on Comparison by Application

- Exhibit 33: Data Table on Comparison by Application

- 6.3 Spine – Market size and forecast 2022-2027

- Exhibit 34: Chart on Spine – Market size and forecast 2022-2027 ($ billion)

- Exhibit 35: Data Table on Spine – Market size and forecast 2022-2027 ($ billion)

- Exhibit 36: Chart on Spine – Year-over-year growth 2022-2027 (%)

- Exhibit 37: Data Table on Spine – Year-over-year growth 2022-2027 (%)

- 6.4 Knee – Market size and forecast 2022-2027

- Exhibit 38: Chart on Knee – Market size and forecast 2022-2027 ($ billion)

- Exhibit 39: Data Table on Knee – Market size and forecast 2022-2027 ($ billion)

- Exhibit 40: Chart on Knee – Year-over-year growth 2022-2027 (%)

- Exhibit 41: Data Table on Knee – Year-over-year growth 2022-2027 (%)

- 6.5 Hip – Market size and forecast 2022-2027

- Exhibit 42: Chart on Hip – Market size and forecast 2022-2027 ($ billion)

- Exhibit 43: Data Table on Hip – Market size and forecast 2022-2027 ($ billion)

- Exhibit 44: Chart on Hip – Year-over-year growth 2022-2027 (%)

- Exhibit 45: Data Table on Hip – Year-over-year growth 2022-2027 (%)

- 6.6 Extremities – Market size and forecast 2022-2027

- Exhibit 46: Chart on Extremities – Market size and forecast 2022-2027 ($ billion)

- Exhibit 47: Data Table on Extremities – Market size and forecast 2022-2027 ($ billion)

- Exhibit 48: Chart on Extremities – Year-over-year growth 2022-2027 (%)

- Exhibit 49: Data Table on Extremities – Year-over-year growth 2022-2027 (%)

- 6.7 Others – Market size and forecast 2022-2027

- Exhibit 50: Chart on Others – Market size and forecast 2022-2027 ($ billion)

- Exhibit 51: Data Table on Others – Market size and forecast 2022-2027 ($ billion)

- Exhibit 52: Chart on Others – Year-over-year growth 2022-2027 (%)

- Exhibit 53: Data Table on Others – Year-over-year growth 2022-2027 (%)

- 6.8 Market opportunity by Application

- Exhibit 54: Market opportunity by Application ($ billion)

- Exhibit 55: Data Table on Market opportunity by Application ($ billion)

7 Market Segmentation by Product

- 7.1 Market segments

- Exhibit 56: Chart on Product – Market share 2022-2027 (%)

- Exhibit 57: Data Table on Product – Market share 2022-2027 (%)

- 7.2 Comparison by Product

- Exhibit 58: Chart on Comparison by Product

- Exhibit 59: Data Table on Comparison by Product

- 7.3 Orthopedic implants and support devices – Market size and forecast 2022-2027

- Exhibit 60: Chart on Orthopedic implants and support devices – Market size and forecast 2022-2027 ($ billion)

- Exhibit 61: Data Table on Orthopedic implants and support devices – Market size and forecast 2022-2027 ($ billion)

- Exhibit 62: Chart on Orthopedic implants and support devices – Year-over-year growth 2022-2027 (%)

- Exhibit 63: Data Table on Orthopedic implants and support devices – Year-over-year growth 2022-2027 (%)

- 7.4 Orthobiologics – Market size and forecast 2022-2027

- Exhibit 64: Chart on Orthobiologics – Market size and forecast 2022-2027 ($ billion)

- Exhibit 65: Data Table on Orthobiologics – Market size and forecast 2022-2027 ($ billion)

- Exhibit 66: Chart on Orthobiologics – Year-over-year growth 2022-2027 (%)

- Exhibit 67: Data Table on Orthobiologics – Year-over-year growth 2022-2027 (%)

- 7.5 Market opportunity by Product

- Exhibit 68: Market opportunity by Product ($ billion)

- Exhibit 69: Data Table on Market opportunity by Product ($ billion)

8 Customer Landscape

- 8.1 Customer landscape overview

- Exhibit 70: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

- 9.1 Geographic segmentation

- Exhibit 71: Chart on Market share by geography 2022-2027 (%)

- Exhibit 72: Data Table on Market share by geography 2022-2027 (%)

- 9.2 Geographic comparison

- Exhibit 73: Chart on Geographic comparison

- Exhibit 74: Data Table on Geographic comparison

- 9.3 North America – Market size and forecast 2022-2027

- Exhibit 75: Chart on North America – Market size and forecast 2022-2027 ($ billion)

- Exhibit 76: Data Table on North America – Market size and forecast 2022-2027 ($ billion)

- Exhibit 77: Chart on North America – Year-over-year growth 2022-2027 (%)

- Exhibit 78: Data Table on North America – Year-over-year growth 2022-2027 (%)

- 9.4 Europe – Market size and forecast 2022-2027

- Exhibit 79: Chart on Europe – Market size and forecast 2022-2027 ($ billion)

- Exhibit 80: Data Table on Europe – Market size and forecast 2022-2027 ($ billion)

- Exhibit 81: Chart on Europe – Year-over-year growth 2022-2027 (%)

- Exhibit 82: Data Table on Europe – Year-over-year growth 2022-2027 (%)

- 9.5 Asia – Market size and forecast 2022-2027

- Exhibit 83: Chart on Asia – Market size and forecast 2022-2027 ($ billion)

- Exhibit 84: Data Table on Asia – Market size and forecast 2022-2027 ($ billion)

- Exhibit 85: Chart on Asia – Year-over-year growth 2022-2027 (%)

- Exhibit 86: Data Table on Asia – Year-over-year growth 2022-2027 (%)

- 9.6 Rest of World (ROW) – Market size and forecast 2022-2027

- Exhibit 87: Chart on Rest of World (ROW) – Market size and forecast 2022-2027 ($ billion)

- Exhibit 88: Data Table on Rest of World (ROW) – Market size and forecast 2022-2027 ($ billion)

- Exhibit 89: Chart on Rest of World (ROW) – Year-over-year growth 2022-2027 (%)

- Exhibit 90: Data Table on Rest of World (ROW) – Year-over-year growth 2022-2027 (%)

- 9.7 US – Market size and forecast 2022-2027

- Exhibit 91: Chart on US – Market size and forecast 2022-2027 ($ billion)

- Exhibit 92: Data Table on US – Market size and forecast 2022-2027 ($ billion)

- Exhibit 93: Chart on US – Year-over-year growth 2022-2027 (%)

- Exhibit 94: Data Table on US – Year-over-year growth 2022-2027 (%)

- 9.8 China – Market size and forecast 2022-2027

- Exhibit 95: Chart on China – Market size and forecast 2022-2027 ($ billion)

- Exhibit 96: Data Table on China – Market size and forecast 2022-2027 ($ billion)

- Exhibit 97: Chart on China – Year-over-year growth 2022-2027 (%)

- Exhibit 98: Data Table on China – Year-over-year growth 2022-2027 (%)

- 9.9 Germany – Market size and forecast 2022-2027

- Exhibit 99: Chart on Germany – Market size and forecast 2022-2027 ($ billion)

- Exhibit 100: Data Table on Germany – Market size and forecast 2022-2027 ($ billion)

- Exhibit 101: Chart on Germany – Year-over-year growth 2022-2027 (%)

- Exhibit 102: Data Table on Germany – Year-over-year growth 2022-2027 (%)

- 9.10 France – Market size and forecast 2022-2027

- Exhibit 103: Chart on France – Market size and forecast 2022-2027 ($ billion)

- Exhibit 104: Data Table on France – Market size and forecast 2022-2027 ($ billion)

- Exhibit 105: Chart on France – Year-over-year growth 2022-2027 (%)

- Exhibit 106: Data Table on France – Year-over-year growth 2022-2027 (%)

- 9.11 Japan – Market size and forecast 2022-2027

- Exhibit 107: Chart on Japan – Market size and forecast 2022-2027 ($ billion)

- Exhibit 108: Data Table on Japan – Market size and forecast 2022-2027 ($ billion)

- Exhibit 109: Chart on Japan – Year-over-year growth 2022-2027 (%)

- Exhibit 110: Data Table on Japan – Year-over-year growth 2022-2027 (%)

- 9.12 Market opportunity by geography

- Exhibit 111: Market opportunity by geography ($ billion)

- Exhibit 112: Data Tables on Market opportunity by geography ($ billion)

10 Drivers, Challenges, and Trends

- 10.1 Market drivers

- 10.2 Market challenges

- 10.3 Impact of drivers and challenges

- Exhibit 113: Impact of drivers and challenges in 2022 and 2027

- 10.4 Market trends

11 Vendor Landscape

- 11.1 Overview

- 11.2 Vendor landscape

- Exhibit 114: Overview on Criticality of inputs and Factors of differentiation

- 11.3 Landscape disruption

- Exhibit 115: Overview on factors of disruption

- 11.4 Industry risks

- Exhibit 116: Impact of key risks on business

12 Vendor Analysis

- 12.1 Vendors covered

- Exhibit 117: Vendors covered

- 12.2 Market positioning of vendors

- Exhibit 118: Matrix on vendor position and classification

- 12.3 aap Implantate AG

- Exhibit 119: aap Implantate AG – Overview

- Exhibit 120: aap Implantate AG – Product / Service

- Exhibit 121: aap Implantate AG – Key offerings

- 12.4 Alphatec Holdings Inc.

- Exhibit 122: Alphatec Holdings Inc. – Overview

- Exhibit 123: Alphatec Holdings Inc. – Product / Service

- Exhibit 124: Alphatec Holdings Inc. – Key offerings

- 12.5 B. Braun SE

- Exhibit 125: B. Braun SE – Overview

- Exhibit 126: B. Braun SE – Business segments

- Exhibit 127: B. Braun SE – Key news

- Exhibit 128: B. Braun SE – Key offerings

- Exhibit 129: B. Braun SE – Segment focus

- 12.6 Colfax Corp.

- Exhibit 130: Colfax Corp. – Overview

- Exhibit 131: Colfax Corp. – Business segments

- Exhibit 132: Colfax Corp. – Key news

- Exhibit 133: Colfax Corp. – Key offerings

- Exhibit 134: Colfax Corp. – Segment focus

- 12.7 Conmed Corp.

- Exhibit 135: Conmed Corp. – Overview

- Exhibit 136: Conmed Corp. – Business segments

- Exhibit 137: Conmed Corp. – Key offerings

- Exhibit 138: Conmed Corp. – Segment focus

- 12.8 CTL Amedica Corp.

- Exhibit 139: CTL Amedica Corp. – Overview

- Exhibit 140: CTL Amedica Corp. – Product / Service

- Exhibit 141: CTL Amedica Corp. – Key offerings

- 12.9 Exactech Inc.

- Exhibit 142: Exactech Inc. – Overview

- Exhibit 143: Exactech Inc. – Product / Service

- Exhibit 144: Exactech Inc. – Key offerings

- 12.10 Integra Lifesciences Holdings Corp.

- Exhibit 145: Integra Lifesciences Holdings Corp. – Overview

- Exhibit 146: Integra Lifesciences Holdings Corp. – Business segments

- Exhibit 147: Integra Lifesciences Holdings Corp. – Key news

- Exhibit 148: Integra Lifesciences Holdings Corp. – Key offerings

- Exhibit 149: Integra Lifesciences Holdings Corp. – Segment focus

- 12.11 Johnson and Johnson

- Exhibit 150: Johnson and Johnson – Overview

- Exhibit 151: Johnson and Johnson – Business segments

- Exhibit 152: Johnson and Johnson – Key news

- Exhibit 153: Johnson and Johnson – Key offerings

- Exhibit 154: Johnson and Johnson – Segment focus

- 12.12 Medtronic Plc

- Exhibit 155: Medtronic Plc – Overview

- Exhibit 156: Medtronic Plc – Business segments

- Exhibit 157: Medtronic Plc – Key news

- Exhibit 158: Medtronic Plc – Key offerings

- Exhibit 159: Medtronic Plc – Segment focus

- 12.13 MicroPort Scientific Corp.

- Exhibit 160: MicroPort Scientific Corp. – Overview

- Exhibit 161: MicroPort Scientific Corp. – Business segments

- Exhibit 162: MicroPort Scientific Corp. – Key offerings

- Exhibit 163: MicroPort Scientific Corp. – Segment focus

- 12.14 Nuvasive Inc.

- Exhibit 164: Nuvasive Inc. – Overview

- Exhibit 165: Nuvasive Inc. – Business segments

- Exhibit 166: Nuvasive Inc. – Key news

- Exhibit 167: Nuvasive Inc. – Key offerings

- Exhibit 168: Nuvasive Inc. – Segment focus

- 12.15 Smith and Nephew plc

- Exhibit 169: Smith and Nephew plc – Overview

- Exhibit 170: Smith and Nephew plc – Business segments

- Exhibit 171: Smith and Nephew plc – Key news

- Exhibit 172: Smith and Nephew plc – Key offerings

- Exhibit 173: Smith and Nephew plc – Segment focus

- 12.16 Stryker Corp.

- Exhibit 174: Stryker Corp. – Overview

- Exhibit 175: Stryker Corp. – Business segments

- Exhibit 176: Stryker Corp. – Key news

- Exhibit 177: Stryker Corp. – Key offerings

- Exhibit 178: Stryker Corp. – Segment focus

- 12.17 Zimmer Biomet Holdings Inc.

- Exhibit 179: Zimmer Biomet Holdings Inc. – Overview

- Exhibit 180: Zimmer Biomet Holdings Inc. – Business segments

- Exhibit 181: Zimmer Biomet Holdings Inc. – Key news

- Exhibit 182: Zimmer Biomet Holdings Inc. – Key offerings

- Exhibit 183: Zimmer Biomet Holdings Inc. – Segment focus

13 Appendix

- 13.1 Scope of the report

- 13.2 Inclusions and exclusions checklist

- Exhibit 184: Inclusions checklist

- Exhibit 185: Exclusions checklist

- 13.3 Currency conversion rates for US$

- Exhibit 186: Currency conversion rates for US$

- 13.4 Research methodology

- Exhibit 187: Research methodology

- Exhibit 188: Validation techniques employed for market sizing

- Exhibit 189: Information sources

- 13.5 List of abbreviations

- Exhibit 190: List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com

SOURCE Technavio