BURLINGTON, Mass., November 20, 2023–(BUSINESS WIRE)–Bone Biologics Corporation (NASDAQ: BBLG), a developer of orthobiologic products for spine fusion markets, today announced the closing of its previously announced registered direct offering priced at-the-market under Nasdaq rules of an aggregate of 1,139,063 of its shares of common stock at a purchase price of $0.64 per share. In a concurrent private placement, the Company also issued and sold unregistered warrants to purchase up to an aggregate of 1,139,063 shares of its common stock. The unregistered warrants have an exercise price of $0.52 per share and are exercisable upon issuance and have a term of five and one-half years from the date of issuance.

H.C. Wainwright & Co. acted as the exclusive placement agent for the offering.

The gross proceeds to Bone Biologics from the offering were approximately $729,000, before deducting the placement agent’s fees and other offering expenses payable by the Company. Bone Biologics currently intends to use the net proceeds from the offering to fund clinical trials, maintain and extend its patent portfolio and for working capital and other general corporate purposes.

The shares of common stock offered in the registered direct offering (but excluding the unregistered warrants offered in the concurrent private placement and the shares of common stock underlying such unregistered warrants) were offered and sold by the Company pursuant to a “shelf” registration statement on Form S-3 (Registration No. 333-265872), including a base prospectus, previously filed with the Securities and Exchange Commission (SEC) on June 28, 2022 and declared effective by the SEC on July 11, 2022. The offering of the shares of common stock issued in the registered direct offering was made only by means of a prospectus supplement that forms a part of the registration statement. A final prospectus supplement and an accompanying base prospectus relating to the registered direct offering was filed with the SEC and is available on the SEC’s website located at http://www.sec.gov. Electronic copies of the final prospectus supplement and accompanying base prospectus may also be obtained by contacting H.C. Wainwright & Co., LLC at 430 Park Avenue, 3rd Floor, New York, NY 10022, by phone at (212) 856-5711 or e-mail at placements@hcwco.com.

The offer and sale of the unregistered warrants in the private placement were made in a transaction not involving a public offering and have not been registered under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and/or Rule 506(b) of Regulation D promulgated thereunder and, along with the shares of common stock underlying such unregistered warrants, have not been registered under the Securities Act or applicable state securities laws. Accordingly, the unregistered warrants offered in the private placement and the underlying shares of common stock may not be offered or sold in the United States except pursuant to an effective registration statement or an applicable exemption from the registration requirements of the Securities Act and such applicable state securities laws.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or jurisdiction.

About Bone Biologics

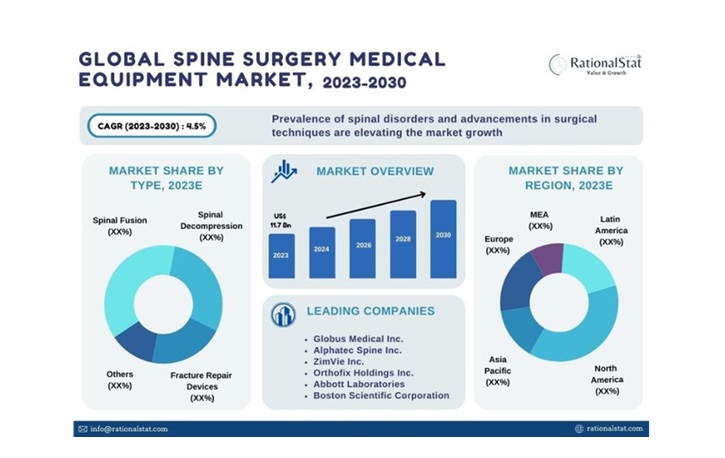

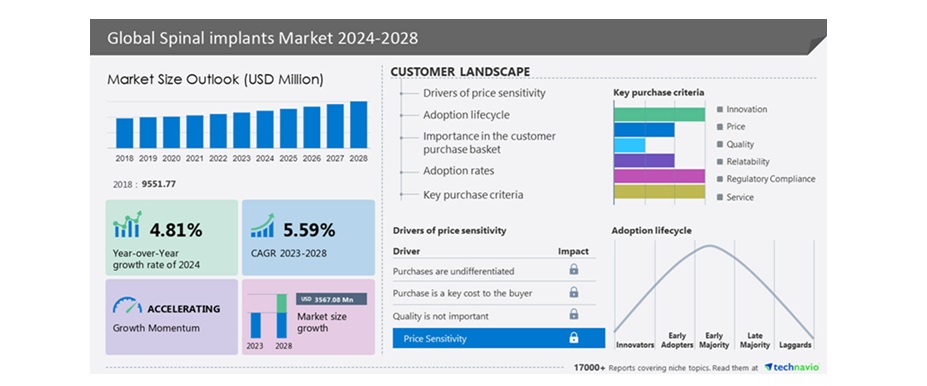

Bone Biologics was founded to pursue regenerative medicine for bone. The Company is undertaking work with select strategic partners that builds on the preclinical research of the Nell-1 protein. Bone Biologics is currently focusing its development efforts for its bone graft substitute product on bone regeneration in spinal fusion procedures, while additionally having rights to trauma and osteoporosis applications. For more information, please visit www.bonebiologics.com.

Forward-looking Statements

Certain statements contained in this press release, including, without limitation, the anticipated use of proceeds from the offering, as well as statements containing the words “believes,” “anticipates,” “expects” and words of similar import, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve both known and unknown risks and uncertainties. The Company’s actual results may differ materially from those anticipated in its forward-looking statements as a result of a number of factors, including, but not limited to, market and other conditions and those including the Company’s ability to develop our lead product NELL-1 and other proposed products, its ability to obtain patent protection for its technology, its ability to obtain the necessary financing to develop products and conduct the necessary clinical testing, its ability to obtain Federal Food and Drug Administration approval to market any product it may develop in the United States and to obtain any other regulatory approval necessary to market any product in other countries, its ability to market any product it may develop, its ability to create, sustain, manage or forecast its growth; its ability to attract and retain key personnel; changes in the Company’s business strategy or development plans; competition; business disruptions; adverse publicity and international, national and local general economic and market conditions and risks generally associated with an undercapitalized developing company, as well as the risks contained under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Form S-1, Form 10-K for the year ended December 31, 2022 and the Company’s other filings with the Securities and Exchange Commission. Except as required by applicable law, we undertake no obligation to revise or update any forward-looking statements to reflect any event or circumstance that may arise after the date hereof.

Contacts

LHA Investor Relations

Kim Sutton Golodetz

212-838-3777

kgolodetz@lhai.com