- Fourth quarter net sales of $1.940 billion increased 6.3% and 6.1% on a constant currency1 basis

- Fourth quarter diluted earnings per share were $2.01; adjusted1 diluted earnings per share were $2.20

- Full-year net sales of $7.394 billion increased 6.5% and 7.5% on a constant currency1 basis

- Full-year diluted earnings per share were $4.88; adjusted1 diluted earnings per share were $7.55

- Company provides full-year 2024 financial guidance

WARSAW, Ind., Feb. 8, 2024 /PRNewswire/ — Zimmer Biomet Holdings, Inc. (NYSE and SIX: ZBH) today reported financial results for the quarter and year ended December 31, 2023. The Company reported fourth quarter net sales of $1.940 billion, an increase of 6.3% over the prior year period, and an increase of 6.1% on a constant currency1 basis. Net sales for the full year were $7.394 billion, an increase of 6.5% over the prior year, and an increase of 7.5% on a constant currency1 basis. Net earnings for the fourth quarter were $419.2 million, or $458.1 million on an adjusted1 basis. For the full year, net earnings were $1.024 billion, or $1.584 billion on an adjusted1 basis.

Diluted earnings per share were $2.01 for the fourth quarter, and adjusted1 diluted earnings per share were $2.20. Full-year diluted earnings per share were $4.88, and adjusted1 diluted earnings per share were $7.55.

1. Reconciliations of these measures to the corresponding U.S. generally accepted accounting principles measures are included in this press release.

“We are pleased to conclude a very successful year with strong fourth quarter results driven by consistent execution, including a healthy second-half growth profile,” said Ivan Tornos, Zimmer Biomet’s President and Chief Executive Officer. “I’m confident in our ability to carry our 2023 momentum into 2024 and to create further value for our stakeholders. As we look ahead, we remain laser focused on our priorities to advance people and culture, achieve operational excellence and drive innovation and diversification to deliver on our Mission.”

Recent Highlights

Aligned with the ongoing transformation of Zimmer Biomet’s business, key recent highlights include:

- Received notification from the U.S. Food and Drug Administration (FDA) officially closing out the FDA Warning Letter for the Warsaw North Campus facility, allowing for the re-allocation of team time and resources to support future innovation and long-term growth

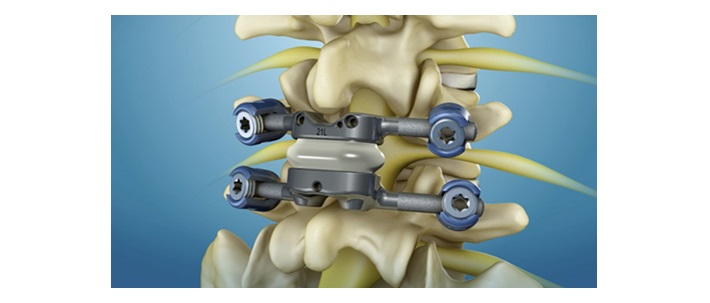

- Introduced HAMMR™, an automated Hip Impaction System for bone preparation and implant placement during hip replacement surgery, strengthening Zimmer Biomet’s portfolio of automated surgical instruments to help surgeons achieve customized control, precision, and energy levels

- Initiated a global restructuring program in late 2023 to optimize our cost base and drive greater efficiencies throughout the Company. These actions underscore our commitment to improving our growth profile and profitability and are expected to result in approximately $200 million in run rate cost savings as we exit 2025

- Completed a $500 million share buyback program in January 2024

- Appointed Louis A. Shapiro to the Zimmer Biomet Board of Directors; as the former President and Chief Executive Officer of the Hospital for Special Surgery (HSS), a leading academic medical center focused on musculoskeletal health, Mr. Shapiro brings a significant depth of industry leadership experience and a unique customer perspective to the ZB Board

- Continued recognition for our Diversity, Equity and Inclusion (DEI) efforts with inclusion in the Newsweek America’s Greatest Workplaces for Diversity 2024 list as well as earning a 100% score on the Human Rights Campaign Foundation’s 2023-2024 Corporate Equality Index

- Received additional recognition for our Environmental, Social and Governance (ESG) efforts from CDP earning an ‘A’ score for climate change based on 2023 disclosures

Geographic and Product Category Sales

The following sales tables provide results by geography and product category for the three-month period and year ended December 31, 2023, as well as the percentage change compared to the applicable prior year period, on both a reported basis and a constant currency basis.