Knee Replacement Market Poised for Growth, Driven by Advancements in Surgical Techniques and Rising Geriatric Population

Pune, Feb. 14, 2025 (GLOBE NEWSWIRE) — Knee Replacement Market Size & Growth Analysis:

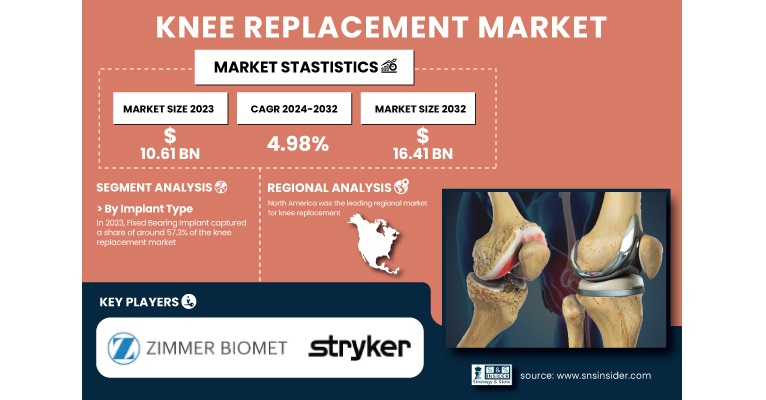

“According to SNS Insider, The Knee Replacement Market size was valued at USD 10.61 billion in 2023 and is projected to reach USD 16.41 billion by 2032, growing at a CAGR of 4.98% over the forecast period from 2024 to 2032.”

The growth of the knee replacement market is primarily attributed to the increasing prevalence of knee osteoarthritis, advancements in knee replacement procedures, and the rising geriatric population. As aging populations worldwide continue to grow, the demand for knee replacements is expected to rise, further fueling the market.

Get a Sample Report of Knee Replacement Market@ https://www.snsinsider.com/sample-request/1055

Major Players Analysis Listed in this Report are:

- Zimmer Biomet (Persona Knee System, NexGen Knee System, Oxford Partial Knee, Gender Solutions Knee System)

- Stryker (Triathlon Knee System, Scorpio NRG, K2 Knee System, Durum High Performance Insert)

- DePuy Synthes (Johnson & Johnson Services, Inc.) (ATTUNE Knee System, Sigma Knee System, VELYS Robotics System)

- Smith & Nephew (JOURNEY II XR Knee, LEGION Knee System, GENESIS II Knee System)

- Aesculap, Inc. (B. Braun) (Evolution Total Knee System, Aesculap Knee System)

- Medacta International (MyKnee, GMK Sphere, GMK Total Knee System)

- MicroPort Scientific Corporation (EVOLIS Knee System, Journey II BCS Knee System)

- Conformis (iTotal CR, iUni Partial Knee System)

- SurgTech Inc. (Surgical tools and robotics, specific knee implant products not listed)

- Corin Group (Persona Partial Knee System)

Knee Replacement Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.61 billion |

| Market Size by 2032 | US$ 16.41 billion |

| CAGR | CAGR of 4.98% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | Increasing Prevalence of Osteoarthritis and Innovations in Implant Technology Propel Market Growth |

Market Segment Insights

By Implant Type Segment, the fixed-bearing implant segment held the largest share of the knee replacement market, with 57.3% of the market share in 2023.

Fixed-bearing implants are much favored in knee replacements because of their impressive durability and stability. It is an implant that provides reliable, long-term outcomes, and this fact alone is enough to influence preference, especially in total knee arthroplasty (TKA). The support for normal daily activities, combined with functionality and alignment, is a significant impetus for their use. Additionally, fixed-bearing implants have a relatively lower complication rate, contributing to their popularity among both surgeons and patients. As surgical techniques continue to improve and more individuals seek effective solutions for knee joint degeneration, the demand for these implants is expected to rise steadily.

By Procedure Segment, the total knee arthroplasty (TKA) segment was the largest in the knee replacement market in 2023, accounting for 64.5% of the market share.

The most common knee replacement procedure is TKA. Individuals experiencing severe cases of osteoarthritis, leading to degeneration in the knee joint, are mostly treated with the TKA procedure. Replacing a diseased knee joint with a prosthetic is a very common treatment for someone diagnosed with a high-grade condition of the knee. High success rates and increased application of minimally invasive techniques in TKA make it highly predominant in the market. Furthermore, the increasing number of patients opting for knee replacements to regain mobility and improve quality of life is expected to drive sustained growth in this segment.

By End-User Segment, in 2023, hospitals accounted for the largest share of the knee replacement market, with 64.8% of the market share.

Hospitals are still the most dominant end-users of the knee replacement surgery market, mainly because they have comprehensive infrastructure, experienced medical teams, and the ability to handle complex surgical procedures. The availability of advanced medical equipment and post-surgical care facilities ensures that patients recover smoothly. However, ambulatory surgical centers (ASCs) are emerging as the fastest-growing segment. ASCs offer a more cost-effective alternative to traditional hospital settings, with the added benefit of faster recovery times and outpatient services. This convenience, coupled with lower costs, makes ASCs increasingly attractive to patients seeking knee replacement surgeries, driving their rapid adoption and growth in the market.

Need any customization research on Knee Replacement Market, Enquire Now@ https://www.snsinsider.com/enquiry/1055

Regional Insights

North America dominated the knee replacement market in 2023, capturing a substantial market share.

Due to the development of advanced healthcare infrastructure, the high adoption rate for modern medical technologies, and the increasing incidence rate of age-related knee disorders. The North American market has a majority share of the United States; this is because developments in surgical techniques such as minimally invasive surgery increase the demand for knee replacement.

The Asia-Pacific region is considered to be the most rapidly developing market for knee replacements, due to rapid advancement in healthcare infrastructure, increased investment in healthcare, and a patient population that’s increasing. Growth is being experienced by countries like China, India, and Japan about knee replacement surgeries due to rising awareness of orthopedic solutions and improvements in access to healthcare.

Knee Replacement Market Segmentation

By Implant Type

- Mobile bearing

- Fixed bearing

- Others

By Procedure

- Partial knee arthroplasty

- Total knee arthroplasty

- Revision knee arthroplasty

By End User

- Hospitals

- Ambulatory surgical centers

- Orthopedic clinics

- Others

Buy a Single-User PDF of Knee Replacement Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/1055

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of Knee Osteoarthritis (OA) and Related Conditions (2023)

5.2 Knee Replacement Procedure Trends (2023)

5.3 Prescription Trends of Knee Replacement Products (2023)

5.4 Device Volume, by Region (2020-2032)

5.5 Post-Surgical Rehabilitation Trends (2023)

6. Competitive Landscape

7. Knee Replacement Market by Implant Type

8. Knee Replacement Market by Procedure

9. Knee Replacement Market by End User

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Details of Knee Replacement Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/reports/knee-replacement-market-1055

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.