- Fourth quarter net sales of $2.244 billion increased 10.9% on a reported basis, 9.2% on a constant currency1 basis and 5.4% on an organic constant currency1 basis

- Fourth quarter diluted earnings per share were $0.70, a decrease of 41.7%; adjusted1 diluted earnings per share were $2.42, an increase of 4.8%

- Full-year net sales of $8.232 billion increased 7.2% on a reported basis, 6.4% on a constant currency1 basis and 3.9% on an organic constant currency1 basis

- Full-year diluted earnings per share were $3.55, a decrease of 19.9%; adjusted1 diluted earnings per share were $8.20, an increase of 2.5%

- Company provides full-year 2026 financial guidance

WARSAW, Ind., Feb. 10, 2026 /PRNewswire/ — Zimmer Biomet Holdings, Inc. (NYSE and SIX: ZBH) today reported financial results for the quarter and year ended December 31, 2025. The Company reported fourth quarter net sales of $2.244 billion, an increase of 10.9% over the prior year period, an increase of 9.2% on a constant currency1 basis and an increase of 5.4% on an organic constant currency1 basis. Net sales for the full year were $8.232 billion, an increase of 7.2% over the prior year, an increase of 6.4% on a constant currency1 basis and an increase of 3.9% on an organic constant currency1 basis. Net earnings for the fourth quarter were $139.3 million, or $479.7 million on an adjusted1 basis. For the full year, net earnings were $705.1 million, or $1.629 billion on an adjusted1 basis.

Diluted earnings per share were $0.70 for the fourth quarter, a decrease of 41.7%, and adjusted1 diluted earnings per share were $2.42, an increase of 4.8%. Full-year diluted earnings per share were $3.55, a decrease of 19.9%, and adjusted1 diluted earnings per share were $8.20, an increase of 2.5%. Zimmer Biomet generated $1.697 billion in operating cash flow and $1.172 billion of free cash flow for the year.

Additionally, on February 9, 2026, Zimmer Biomet’s Board of Directors approved a new stock repurchase authorization, granting the Company authority to repurchase up to $1.5 billion in common stock. The new authorization commences on February 9, 2026 and has no expiration date. Under the program, which is designed to return value to Zimmer Biomet’s shareholders and minimize dilution from stock issuances, the Company may repurchase shares in the open market and enter into structured repurchase agreements with third parties.

“We made significant strategic and financial progress in 2025, delivering on our initial revenue growth, EPS and free cash flow commitments and integrating three acquisitions, all while navigating tariff headwinds,” said Ivan Tornos, Chairman, President and CEO of Zimmer Biomet. “We closed the year strong with meaningful revenue acceleration and two consecutive quarters of mid-single digit organic growth fueled by our new product innovation cycle. As we enter 2026, we are excited about our transition to a predominantly direct and specialized sales organization in the U.S. While this bold action tempers our 2026 sales guidance, we are confident that it will drive durable long-term growth and solidify our position as the undisputed market leader. Against this backdrop, we are committed to delivering EPS and free cash flow growth while continuing to return capital to shareholders in a meaningful way.”

| ____________________ |

| 1 Reconciliations of these measures to the corresponding U.S. generally accepted accounting principles measures are included in this press release. |

Recent Highlights

- Completed $250 million of share repurchases during the fourth quarter of fiscal 2025.

- Received board authorization to repurchase up to $1.5 billion in shares.

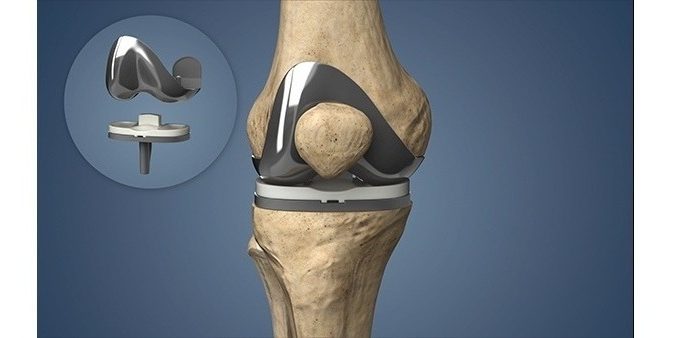

- Received U.S. FDA clearance for ROSA® Knee with OptimiZeTM, the most advanced upgrade to the Company’s flagship robotic knee system since its launch in 2019.

- Enabled the world’s first iodine-treated hip procedure to be performed in Japan using iTaperloc® Complete and iG7™ Acetabular Hip Systems to address infection management by inhibiting biofilm formation.

- Launched Brachiator™ Mini-Rail External Fixation System through Paragon 28 subsidiary to address complex, small bone reconstruction in the foot and ankle.

- Announced two new mymobility® data analytics collaborations: (1) OneStep to improve mobility data capture through smartphones; and (2) PatientIQ to seamlessly integrate orthopedic recovery data and patient reported outcomes in electronic health records.

- Named to Forbes’ 2026 list of America’s Best Companies, honoring organizations that lead the way in corporate trust, innovation, customer sentiment, employee satisfaction and workplace culture.

Geographic and Product Category Sales

The following sales tables provide results by geography and product category for the three-month period and year ended December 31, 2025, as well as the percentage change compared to the applicable prior year period, on both a reported basis and a constant currency basis. Percentage change is also presented on an organic constant currency basis to exclude the impact on net sales from the April 2025 acquisition of Paragon 28, Inc. (“Paragon 28”).