Boston, MA., December 11, 2023 – OrthoSpineNews –

NanoHive Medical, LLC, a highly innovative spinal orthopedics company, is

pleased to announce the closing of a venture debt round to support continued

adoption of its proprietary Soft Titanium® interbody fusion devices. The debt

was provided by Kenston Capital Partners, LLC and its affiliates with Outcome

Capital, LLC acting as strategic and financial advisor to NanoHive Medical.

“This capital infusion allows the company to capture the attention of

leading surgeons and convert them to our best-in-class portfolio more

aggressively. As we continue to produce consecutive month-overmonth record

sales, Kenston Capital’s participation enables this trend to continue,” said

Patrick O’Donnell, CEO of NanoHive Medical.

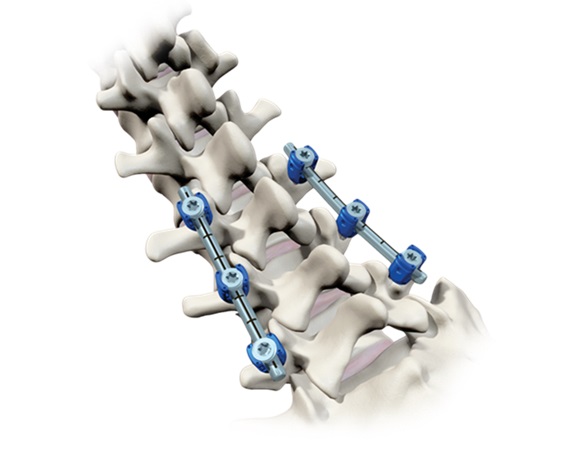

NanoHive’s highly differentiated lattice structure provides enhanced

visualization and reduced density as compared to alternatives, while also

achieving sufficient durability and strength for biomechanical loads.

Specifically designed geometry using a rhombic dodecahedron cell structure

creates a base structure similar to cancellous bone, and provides ideal

biomechanical elastic modulus properties. Manufactured with 3D printed

titanium, the NanoHive interbody portfolio spans anterior and posterior lumbar,

as well as cervical applications.

“We were drawn both to the value of the underlying IP and the exciting

financial picture being painted from early, yet strong, commercial traction.

Kenston Capital was delighted to participate in this debt financing, and looks

forward to assisting other growth-stage life sciences and medical device

companies,” commented James Kenney, Managing Partner of Kenston Capital

Partners.

“At Outcome Capital, we pride ourselves in finding not only appropriate, but

innovative capital solutions for our clients to take their companies and

technologies to the next stage. It was a pleasure working with Kenston, and we

are excited to see NanoHive take their next commercial step,” noted Arnold

Freedman, Managing Partner of Outcome Capital.

About NanoHive Medical, LLC

NanoHive Medical is a pioneer and leading innovator in 3D printed spinal

interbody fusion implants and instrumentation. The company’s proprietary,

biomimetic Soft Titanium® technology clearly distinguishes their products in

the $1.9B spinal interbody fusion device market. The Hive™ portfolio of

interbody fusion devices offers surgeons and their patients a set of

exceptional characteristics, including optimal biomechanical elastic modulus

properties, precise diagnostic imaging capabilities, and ideal osteoblast cell

attraction and integration qualities. These features may consistently

contribute to strong fusion constructs and positive clinical experiences.

NanoHive Medical is located in Woburn, Massachusetts U.S.A

Contact: Patrick O’Donnell, CEO & President, Patrick.odonnell@nanohive.com

Website: www.nanohive.com

About Outcome Capital, LLC

Outcome Capital (outcomecapital.com) is a highly specialized life sciences

and healthcare advisory and investment banking firm, providing innovative

companies with a value-added, market-aligned approach to mergers &

acquisitions, partnering and corporate finance. The firm leverages its proven

‘strategy-led execution’ approach to value enhancement by assisting management

teams and their boards in navigating both financial and corporate markets and

implementing the best path for success. The firm’s strength stems from its

multi-disciplinary, industry experts who draw from their broad relationships

and a wide range of scientific, operational, strategic, and transactional

expertise across the value chain. Comprised of former CEOs, business

development executives, venture capitalists, PhD/MD-level scientists and

clinicians, and experienced commercialization experts, Outcome’s team is driven

to propel innovation from bench to bedside.

About Kenston Capital Partners, LLC

Kenston Capital Partners (kenstoncapital.com) provides senior secured

venture debt financing to highgrowth, early-stage technology & healthcare

companies. Through flexible and scalable transactions that leverage recent

equity financings, Kenston Capital Partners provides minimally dilutive capital

to enable our borrowers to execute on their growth and innovation trajectory.

Since 2005, the Partners of Kenston Capital have originated more than $100

million in venture loans to more than 60 companies.

###