Presents Global and Country-Level Growth Trends for ENT, Orthopedic & Spine, Neurology, Dental, and Other Applications. Profiles 10+ Industry Giants, Including Medtronic, Stryker Corporation, Brainlab, Zimmer Biomet, and Smith & Nephew.

Dublin, Jan. 14, 2025 (GLOBE NEWSWIRE) — The “Surgical Navigation Systems Market by Technology, Application, End User and Region” report has been added to ResearchAndMarkets.com’s offering. This comprehensive research report focuses on the global and regional market size and forecasts from 2024 to 2035.

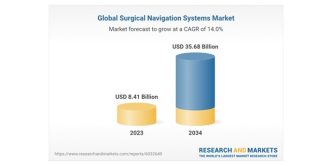

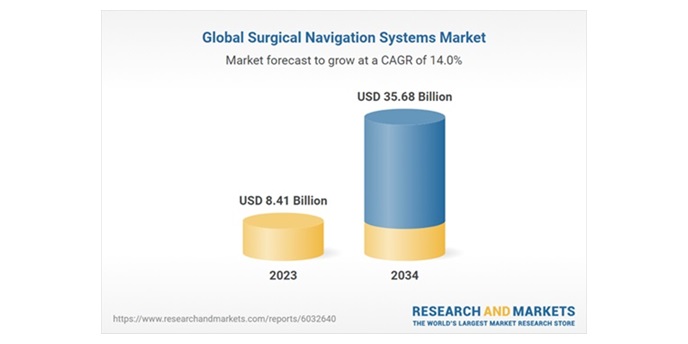

The global surgical navigation systems market was estimated at USD 8.41 billion in 2024 and is expected to reach USD 35.68 billion by 2035, with a CAGR of 14.04% from 2025-2035. The market will grow as a result of rising demand for minimally invasive surgeries, expanding adoption of robotic-assisted surgery (RAS) systems, rising rates of chronic illnesses, technological advancements, emerging markets, growing healthcare awareness, and strategic alliances and partnerships.

The growing adoption of robotic-assisted surgical systems, such as Intuitive Surgical’s da Vinci systems, is driving the surgical navigation systems market. According to the company’s 2023 annual report, the installed base of da Vinci systems reached 8,606 units globally, with significant concentrations in key healthcare markets like the U.S., Europe, and Asia. This widespread deployment facilitated approximately 2,286,000 surgical procedures in 2023 alone, emphasizing the increasing reliance on RAS for precision, reduced invasiveness, and enhanced patient outcomes. The integration of surgical navigation technology with robotic platforms further enhances procedural accuracy, fueling market growth.

North America is anticipated to have the highest revenue share during the forecast period owing to the well-established healthcare infrastructure, high adoption of advanced surgical technologies, a strong presence of key market players, and a growing number of minimally invasive and robotic-assisted surgeries. Additionally, Asia Pacific is predicted to grow at the fastest CAGR during the forecast period owing to the rising healthcare investments, increasing prevalence of chronic diseases requiring surgical interventions, expanding access to advanced medical technologies, and growing awareness about the benefits of surgical navigation systems in emerging economies. For instance, in June 2023, Zeta Surgical conducted a groundbreaking human experiment at the National Neuroscience Institute (NNI), Singapore, successfully treating the first patient with its cranial navigation system.

Market Segmentation Trends

By technology, the electromagnetic segment accounted for the highest revenue-grossing segment in the global surgical navigation systems market in 2024 owing to the widespread adoption of these systems for complex procedures such as spinal and cranial surgeries due to their superior accuracy and reliability in tracking surgical instruments. For instance, in April 2024, Medtronic introduced its NeuroSmartTM Portable Micro Electrode Recording (MER) Navigation system in India. This system uses DBS to treat Parkinson’s illness. Additionally, the optical segment is predicted to grow at the fastest CAGR during the forecast period owing to the advancements in imaging technology, which provide high-resolution, real-time visuals, enhancing precision during minimally invasive surgeries.

By application, the neurology segment accounted for the highest revenue-grossing segment in the global surgical navigation systems market in 2024 owing to the increasing prevalence of neurological disorders such as brain tumors and epilepsy, coupled with the critical need for precise surgical navigation in cranial procedures. According to statistics released by the World Federation of Neurology in October 2023, neurological conditions rank as the second leading cause of death and disability globally. According to a study on the Global Burden of Disease (GBD), by 2050, the number of people with neurological illnesses is predicted to double. Additionally, the ENT segment is predicted to grow at the fastest CAGR during the forecast period owing to its rising adoption in sinus and skull base surgeries, driven by the demand for minimally invasive approaches that improve surgical outcomes.

By end-user, the hospital segment accounted for the highest revenue-grossing segment in the global surgical navigation systems market in 2024 owing to the availability of advanced surgical equipment, skilled professionals, and high patient inflow for complex surgical procedures. For instance, Stryker released the Q Guidance System and Cranial Guidance Software in July 2023 to provide surgeons with an intraoperative guidance and planning system based on images. During cranial surgery, this technique aids surgeons in identifying patient anatomy and positioning equipment. Additionally, the ambulatory surgical centers (ASCs) segment is predicted to grow at the fastest CAGR during the forecast period owing to the increasing preference for cost-effective and time-efficient surgical settings, particularly for outpatient procedures.

Study Coverage

- Market Forecast by Technology, Application, and End User

- Market Forecast for 5 Regions and 17+ Countries

- North America (U.S. and Canada)

- Europe (Germany, France, UK, Spain, Italy, Russia, Rest of Europe)

- Asia Pacific (China, Japan, India, Australia, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Argentina, Rest of LATAM)

- MEA (South Africa, GCC, Rest of MEA)

- Exhaustive Company Profiles of the Top 10+ Market Players

- Medtronic

- Stryker Corporation

- Brainlab AG

- Zimmer Biomet

- Smith & Nephew

- DePuy Synthes (Johnson & Johnson)

- GE Healthcare

- Siemens Healthineers

- Karl Storz GmbH & Co. KG

- Fiagon GmbH

- Scopis GmbH (acquired by Stryker)

- Intuitive Surgical, Inc.

- ClaroNav Inc.

- B. Braun Melsungen AG

- 7D Surgical (acquired by SeaSpine)

- 20% Free Customization Available to Meet Your Exact Requirements

Surgical Navigation Systems Market Analysis & Forecast by Technology 2024 – 2035 (Revenue USD Bn)

- Electromagnetic

- Optical

- Others

Surgical Navigation Systems Market Analysis & Forecast by Application 2024 – 2035 (Revenue USD Bn)

- ENT

- Orthopedic and Spine

- Neurology

- Dental

- Others

Surgical Navigation Systems Market Analysis & Forecast by End-User 2024 – 2035 (Revenue USD Bn)

- Hospitals

- ASCs

- Others

Key Attributes

| Report Attribute | Details |

| No. of Pages | 200 |

| Forecast Period | 2023-2034 |

| Estimated Market Value (USD) in 2023 | $8.41 Billion |

| Forecasted Market Value (USD) by 2034 | $35.68 Billion |

| Compound Annual Growth Rate | 14% |

| Regions Covered | Global |

For more information about this report visit https://www.researchandmarkets.com/r/srnmek

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Source: Research and Markets